» książki » Business & Economics - Accounting - Governmental

|

Overview of the United States Department of Defense Fiscal Year 2014 Budget Request

ISBN: 9781500349820 / Angielski / Miękka / 180 str. Termin realizacji zamówienia: ok. 5-8 dni roboczych. |

cena:

90,84 zł |

|

Interpretation and Application of Ipsas

ISBN: 9781119010296 / Angielski / Miękka / 464 str. Termin realizacji zamówienia: ok. 5-8 dni roboczych. Clear, practical IPSAS guidance, explanation, and examples

Interpretation and Application of IPSAS provides practical guidance on the implementation and application of the International Public Sector Accounting Standards. This book brings readers up to date on the standards, and describes their proper interpretation and real-world application. Examples and mini-case studies clarify the standards' roles throughout, giving readers a better understanding of complex processes, especially where the IPSAS deviate from IFRS. Readers also gain insight into smoothly navigating the... Clear, practical IPSAS guidance, explanation, and examples

Interpretation and Application of IPSAS provides practical guidance on the... |

cena:

274,52 zł |

|

Hochschulcontrolling: Einführung Von Berichtssystemen: Prozesse, Strukturen, Vorgehen

ISBN: 9783110369342 / Niemiecki / Twarda / 406 str. Termin realizacji zamówienia: ok. 5-8 dni roboczych. Vor dem Hintergrund einer sich verandernden Umwelt wird als Losungsansatz ein Hochschulcontrolling-System konzipiert und in einem Referenzmodell fur Berichtssysteme operationalisiert. "Vor dem Hintergrund einer sich verandernden Umwelt wird als Losungsansatz ein Hochschulcontrolling-System konzipiert und in einem Referenzmodell fu... |

cena:

172,55 zł |

|

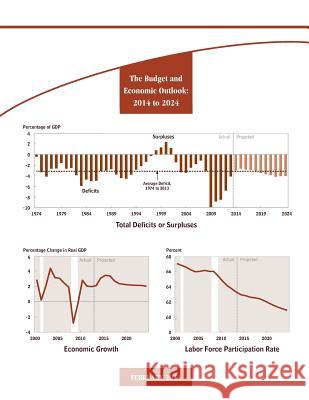

The Budget and Economic Outlook: 2014 to 2024

ISBN: 9781503186644 / Angielski / Miękka / 180 str. Termin realizacji zamówienia: ok. 5-8 dni roboczych. The federal budget deficit has fallen sharply during the past few years, and it is on a path to decline further this year and next year. The Congressional Budget Office (CBO) estimates that under current law, the deficit will total $514 billion in fiscal year 2014, compared with $1.4 trillion in 2009. At that level, this year's deficit would equal 3.0 percent of the nation's economic output, or gross domestic product (GDP)-close to the average percentage of GDP seen during the past 40 years. As it does regularly, CBO has prepared baseline projections of what federal spending, revenues, and...

The federal budget deficit has fallen sharply during the past few years, and it is on a path to decline further this year and next year. The Congressi...

|

cena:

77,18 zł |

|

Edv-Unterstuetzte Optimierung Der Verwaltungssprache in Oesterreich Am Beispiel Einer Einer Oeffentlichen Kontrolleinrichtung

ISBN: 9783631654934 / Niemiecki / Twarda / 175 str. Termin realizacji zamówienia: ok. 5-8 dni roboczych. Aus ihrer Entwicklung umgibt die Verwaltungssprache eine sprachliche Normierung im Hinblick einer Allgemeinverbindlichkeit gegenuber den Adressatinnen bzw. Adressaten, wobei deren historische Kodifikation sowohl in Worterbuchern als auch in sonstigen Aufzeichnungen niedergeschrieben wurde. Dies betrifft auch die verbindliche Einhaltung der Gendergerechten Formulierungen in der osterreichischen Verwaltungssprache: Durch Umformulieren des Satzes soll die bzw. der Handelnde eindeutig in den Prufberichten benannt werden. Diese Arbeit zeigt, inwieweit im Hinblick einer optimalen...

Aus ihrer Entwicklung umgibt die Verwaltungssprache eine sprachliche Normierung im Hinblick einer Allgemeinverbindlichkeit gegenuber den Adressatinnen...

|

cena:

292,75 zł |

|

Money, Reserves, and the Transmission of Monetary Policy: Does the Money Multiplier Exist?

ISBN: 9781503298033 / Angielski / Miękka / 56 str. Termin realizacji zamówienia: ok. 5-8 dni roboczych. With the use of nontraditional policy tools, the level of reserve balances has risen significantly in the United States since 2007. Before the financial crisis, reserve balances were roughly $20 billion whereas the level has risen well past $1 trillion. The effect of reserve balances in simple macroeconomic models often comes through the money multiplier, affecting the money supply and the amount of bank lending in the economy. Most models currently used for macroeconomic policy analysis, however, either exclude money or model money demand as entirely endogenous, thus precluding any causal...

With the use of nontraditional policy tools, the level of reserve balances has risen significantly in the United States since 2007. Before the financi...

|

cena:

68,07 zł |

|

Why is the economy like this?!

ISBN: 9781499091779 / Angielski / Miękka / 56 str. Termin realizacji zamówienia: ok. 5-8 dni roboczych. |

cena:

75,73 zł |

|

Why is the economy like this?!

ISBN: 9781499091786 / Angielski / Twarda / 56 str. Termin realizacji zamówienia: ok. 5-8 dni roboczych. |

cena:

181,79 zł |

|

Accounting at War: The Politics of Military Finance

ISBN: 9781138859791 / Angielski / Twarda / 216 str. Termin realizacji zamówienia: ok. 5-8 dni roboczych. Accounting is frequently portrayed as a value free mechanism for allocating resources and ensuring they are employed in the most efficient manner. Contrary to this popular opinion, the research presented in Accounting at War demonstrates that accounting for military forces is primarily a political practice. Throughout history, military force has been so pervasive that no community of any degree of complexity has succeeded in. Through to the present day, for all nation states, accounting for the military and its operations has primarily served broader political... Accounting is frequently portrayed as a value free mechanism for allocating resources and ensuring they are employed in the most efficient manner. ... |

cena:

782,54 zł |

|

Overview of Federal Accounting Concepts and Standards

ISBN: 9781503369658 / Angielski / Miękka / 50 str. Termin realizacji zamówienia: ok. 5-8 dni roboczych. The federal government derives its just powers from the constent of the governed. It therefore has a special responsibility to report on its actions and the results of those actions. These reports must accurately reflect the distinctive nature of the federal government and must provide information useful to the citizens, their elected representitives, federal executives, and program managers.

The federal government derives its just powers from the constent of the governed. It therefore has a special responsibility to report on its actions a...

|

cena:

72,81 zł |

|

Public Sector Accounting and Auditing in Europe: The Challenge of Harmonization

ISBN: 9781137461339 / Angielski / Twarda / 258 str. Termin realizacji zamówienia: ok. 5-8 dni roboczych. The book provides an overview of the governmental accounting status quo in Europe by analysing the public sector accounting, budgeting and auditing systems in fourteen European countries. IT sheds light on the challenges faced by European countries as they move towards adoption of the European Public Sector Accounting Standards (EPSAS).

The book provides an overview of the governmental accounting status quo in Europe by analysing the public sector accounting, budgeting and auditing sy...

|

cena:

463,70 zł |

|

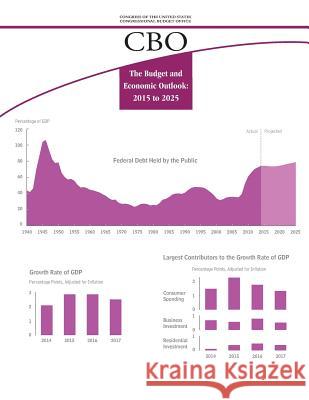

The Budget and Economic Outlook: 2015 to 2025

ISBN: 9781508616146 / Angielski / Miękka / 182 str. Termin realizacji zamówienia: ok. 5-8 dni roboczych. |

cena:

68,07 zł |

|

The $13 Trillion Question: Managing the U.S. Government's Debt

ISBN: 9780815727057 / Angielski / Miękka / 135 str. Termin realizacji zamówienia: ok. 5-8 dni roboczych. The underexamined art and science of managing the federal government's huge debt. Everyone talks about the size of the U.S. national debt, now at $13 trillion and climbing, but few talk about how the U.S. Treasury does the borrowing--even though it is one of the world's largest borrowers. Everyone from bond traders to the home-buying public is affected by the Treasury's decisions about whether to borrow short or long term and what types of bonds to sell to investors. What is the best way for the Treasury to finance the government's huge debt? Harvard's Robin Greenwood, Sam Hanson,... The underexamined art and science of managing the federal government's huge debt. Everyone talks about the size of the U.S. national debt, now at... |

cena:

98,79 zł |

|

Government and Not-For-Profit Accounting, Binder Ready Version: Concepts and Practices

ISBN: 9781118983270 / Angielski / Luźne kartki (loose leaf) / 864 str. Termin realizacji zamówienia: ok. 5-8 dni roboczych. This text is an unbound, three hole punched version. This text is an unbound, three hole punched version. |

cena:

1317,86 zł |

|

Governing Through Regulation: Public Policy, Regulation and the Law

ISBN: 9781138935587 / Angielski / Twarda / 288 str. Termin realizacji zamówienia: ok. 5-8 dni roboczych. Over the past forty years, numerous theoretical advances have been made. From Ayres' and Braithwaite's ground breaking work on 'responsive regulation', we have seen models of 'smart regulation', 'regulatory governance' and 'regulatory capitalism' emerge to capture the growing prevalence and importance of regulation in modern liberal Western capitalist societies. Important advances also have been made in the practice of regulation, with regulators evolving from traditional enforcement focussed 'command and control' models to being 'modern regulators' with a suite of diverse and... Over the past forty years, numerous theoretical advances have been made. From Ayres' and Braithwaite's ground breaking work on 'responsive reg... |

cena:

808,63 zł |

|

Fiscal Tiers (Routledge Revivals): The Economics of Multi-Level Government

ISBN: 9781138648029 / Angielski / Twarda / 326 str. Termin realizacji zamówienia: ok. 5-8 dni roboczych. First published in 1984. This book brings together and develops the economic theory relating to the design and operation of systems of non-central government - positing major developments in several areas. It considers what functions systems most suitably perform in non-central governments, and their appropriate size and structure. How these authorities might finance themselves - by taxes, charges or loans - is analysed in detail. It also examines the use of grants by higher tiers of government and how such programmes should be designed. Concentrating on contemporary economic concerns, it... First published in 1984. This book brings together and develops the economic theory relating to the design and operation of systems of non-central ... |

cena:

756,45 zł |

|

Local Authority Accounting Methods Volume 2 (Rle Accounting): Problems and Solutions, 1909-1934

ISBN: 9781138979970 / Angielski / Miękka / 382 str. Termin realizacji zamówienia: ok. 5-8 dni roboczych. The book contains a collection of papers dealing with a range of controversial accounting issues which exercised the minds of local authority officials during the period 1909-1934 and the "solutions" embodied in the Accounts (Boroughs and Metropolitan Boroughs) Regulations 1930. The contributors to the debate were mainly local government officials and the items reproduced cover a wide range of matters such as the content of the abstract accounts; the need for standardization and an illuminating comparison of the nature and contents of municipal accounts with those of limited companies. A... The book contains a collection of papers dealing with a range of controversial accounting issues which exercised the minds of local authority offic... |

cena:

104,29 zł |

|

Recurring Issues in Auditing (Rle Accounting): Professional Debate 1875-1900

ISBN: 9781138997110 / Angielski / Miękka / 376 str. Termin realizacji zamówienia: ok. 5-8 dni roboczych. |

cena:

151,24 zł |

|

Soldes Financiers Des Collectivités Publiques: Explications Théoriques Et Modélisation Simultanée Des Recettes Et Des Dépenses Des Cantons Suisses

ISBN: 9783039114795 / Francuski / Miękka / 222 str. Termin realizacji zamówienia: ok. 5-8 dni roboczych. Cet ouvrage presente une recherche visant a mieux comprendre le phenomene de l endettement et a s appuyer sur cette connaissance pour formuler des recommandations a l attention des collectivites publiques.

Alors que la plupart des chercheurs ne modelisent que les soldes financiers, l approche adoptee passe par la comparaison de modeles simultanes des recettes et des depenses et de modeles directs des soldes financiers. Apres avoir mis en perspective les elements theoriques et methodologiques utilises, cet ouvrage se concentre sur l analyse econometrique des recettes, des depenses et... Cet ouvrage presente une recherche visant a mieux comprendre le phenomene de l endettement et a s appuyer sur cette connaissance pour formuler des rec...

|

cena:

249,26 zł |

|

Le Code General des Impots du Cameroun Illustre: 2016

ISBN: 9781523456260 / Francuski / Miękka / 296 str. Termin realizacji zamówienia: ok. 5-8 dni roboczych. Le Code General des Impots (CGI) regroupe, au Cameroun, des dispositions relatives au droit fiscal. Il traite les differents types d'impots, les procedures fiscales et la fiscalite locale. Chaque annee, il est mise a jour par la loi de finances. Ainsi, pour faciliter sa comprehension et etre efficace dans la pratique, le present CGI de 2016 a ete annexe des illustrations de plusieurs dispositions d'une part, de la liste des entites tenues de retenir a la source TVA et acompte IR en 2016 d'autre part, et enfin, des definitions de quelques termes fiscaux et en finances publiques."

Le Code General des Impots (CGI) regroupe, au Cameroun, des dispositions relatives au droit fiscal. Il traite les differents types d'impots, les proce...

|

cena:

250,44 zł |