The Budget and Economic Outlook: 2014 to 2024 » książka

The Budget and Economic Outlook: 2014 to 2024

ISBN-13: 9781503186644 / Angielski / Miękka / 2014 / 180 str.

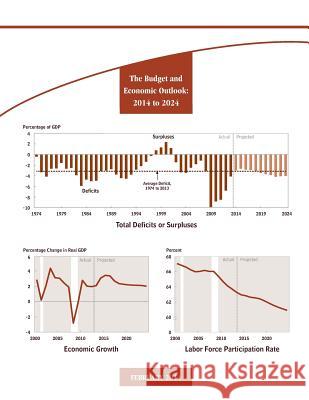

The federal budget deficit has fallen sharply during the past few years, and it is on a path to decline further this year and next year. The Congressional Budget Office (CBO) estimates that under current law, the deficit will total $514 billion in fiscal year 2014, compared with $1.4 trillion in 2009. At that level, this year's deficit would equal 3.0 percent of the nation's economic output, or gross domestic product (GDP)-close to the average percentage of GDP seen during the past 40 years. As it does regularly, CBO has prepared baseline projections of what federal spending, revenues, and deficits would look like over the next 10 years if current laws governing federal taxes and spending generally remained unchanged. Under that assumption, the deficit is projected to decrease again in 2015-to $478 billion, or 2.6 percent of GDP (see Summary Table 1). After that, however, deficits are projected to start rising-both in dollar terms and relative to the size of the economy- because revenues are expected to grow at roughly the same pace as GDP whereas spending is expected to grow more rapidly than GDP. In CBO's baseline, spending is boosted by the aging of the population, the expansion of federal subsidies for health insurance, rising health care costs per beneficiary, and mounting interest costs on federal debt. By contrast, all federal spending apart from outlays for Social Security, major health care programs, and net interest payments is projected to drop to its lowest percentage of GDP since 1940 (the earliest year for which comparable data have been reported).

Zawartość książki może nie spełniać oczekiwań – reklamacje nie obejmują treści, która mogła nie być redakcyjnie ani merytorycznie opracowana.