» książki » Business & Economics - International - Taxation

|

Navigating The Tariff Turbulence: Thriving Amids New Tariffs

ISBN: 9789935549181 / Angielski Termin realizacji zamówienia: ok. 5-8 dni roboczych. |

cena:

79,34 |

|

Consumption Tax Policy and the Taxation of Capital Income

ISBN: 9780198297901 / Angielski / Twarda / 336 str. Termin realizacji zamówienia: ok. 5-8 dni roboczych. This book introduces the substantial literature on consumption tax policy and the taxation of capital income, the early literature on optimal tax theory in dynamic overlapping generations models, the more recent literature on optimal taxation in the Ramsey growth model and models of endogenous growth, and the literature on taxation in open economies.

This book introduces the substantial literature on consumption tax policy and the taxation of capital income, the early literature on optimal tax theo...

|

cena:

732,63 |

|

Peasants Versus City-Dwellers: Taxation and the Burden of Economic Development

ISBN: 9780199253579 / Angielski / Miękka / 240 str. Termin realizacji zamówienia: ok. 5-8 dni roboczych. In this book Nobel Laureate Joseph Stiglitz and co-author Raaj Sah address one of development's major issues. Most of today's countries face town versus country tensions of increasing severity, including such issues as who should pay how much in taxes, who should get how much in subsidies, and what forms the taxes and subsidies should take. This volume analyses these tensions and issues, taking into account the great diversity of institutions and economic environments observed in different developing countries.

In this book Nobel Laureate Joseph Stiglitz and co-author Raaj Sah address one of development's major issues. Most of today's countries face town vers...

|

cena:

227,61 |

|

Offshore: The Dark Side of the Global Economy

ISBN: 9780312425586 / Angielski / Miękka / 288 str. Termin realizacji zamówienia: ok. 5-8 dni roboczych. An unknown realm to many investors, offshore finance allows giant corporations--such as Wal-Mart, British Petroleum, and Citigroup--to legally keep huge profits out of sight of regulators and the public. William Brittain-Catlin tells the story of how tax havens in the Caribbean and elsewhere have become central to global finance today. He takes us through the secret networks of Enron and Parmalat, behind international trade disputes, and into organized crime and terror. This book gives disquieting evidence that, as a result of offshore practices, the key value of capitalism and... An unknown realm to many investors, offshore finance allows giant corporations--such as Wal-Mart, British Petroleum, and Citigroup--to legally keep... |

cena:

87,91 |

|

Tax Systems and Tax Reforms in Europe

ISBN: 9780415322515 / Angielski / Twarda / 336 str. Termin realizacji zamówienia: ok. 5-8 dni roboczych. The past decade has seen important changes taking place in the tax regimes of many European countries. A comprehensive picture of what is happening in European fiscal systems has not been easy to find - until now. This comprehensive volume provides impressive analyses of tax systems and tax reforms in various European countries including France, Germany, Italy and the United Kingdom. With a preface from Vito Tanzi and an impressive range of contributions, the book identifies and analyses the main common forces that drive fiscal reforms such as globalization, European reunification, and fiscal...

The past decade has seen important changes taking place in the tax regimes of many European countries. A comprehensive picture of what is happening in...

|

cena:

584,14 |

|

America: Who Really Pays the Taxes?

ISBN: 9780671871574 / Angielski / Miękka / 384 str. Termin realizacji zamówienia: ok. 5-8 dni roboczych. American: Who Really Pays the Taxes? is a disturbing, eye-opening look at a tax system gone out of control. Originally designed to spread the cost of government fairly, our tax code has turned into a gold mine of loopholes and giveaways manipulated by the influential and wealthy for their own benefit.

If you feel as if the tax laws are rigged against the average taxpayer, you're right: American: Who Really Pays the Taxes? is a disturbing, eye-opening look at a tax system gone out of control. Originally designed to spread the cost of ...

|

cena:

95,36 |

|

Taxing Multinationals: Transfer Pricing and Corporate Income Taxation in North America

ISBN: 9780802007766 / Angielski / Twarda / 856 str. Termin realizacji zamówienia: ok. 5-8 dni roboczych. Governments face complex problems in taxing crossborder, intrafirm transactions of multinational enterprises. Such transactions dominate world trade flows and critically affect national tax revenues. However, their values - transfer prices - are set typically inside the multinationals. As a result, governments have established complicated rules based on the arm's length standard to discourage transfer price manipulation. This book draws on the fields of international business, economics, accounting, law, and public policy as they pertain to transfer pricing. It includes a... Governments face complex problems in taxing crossborder, intrafirm transactions of multinational enterprises. Such transactions dominate world trad... |

cena:

744,78 |

|

Using Tax Incentives to Compete for Foreign Investment: Are They Worth the Costs?

ISBN: 9780821349922 / Angielski / Miękka / 104 str. Termin realizacji zamówienia: ok. 5-8 dni roboczych. This volume consists of two essays both on the use of tax incentives to attract foreign direct investment. The first essay examines this issue in the context of Indonesia. The authors of this essay contend that tax incentives for foreign investors are not part of the solution but may actually be counterproductive. The second essay in this volume provides a review of earlier literature pertaining to the same issues discussed in the first essay.

This volume consists of two essays both on the use of tax incentives to attract foreign direct investment. The first essay examines this issue in the ...

|

cena:

87,57 |

|

Three Simple Principals of Trade Policy

ISBN: 9780844770796 / Angielski / Miękka / 36 str. Termin realizacji zamówienia: ok. 5-8 dni roboczych. This volume addresses what the author calls the three subtle but sensible principles of international trade policy. It demonstrates, for example, that a tax on imports commensurately creates a tax on exports.

This volume addresses what the author calls the three subtle but sensible principles of international trade policy. It demonstrates, for example, that...

|

cena:

38,03 |

|

A Brief History of Taxation

ISBN: 9781905789009 / Angielski / Miękka / 139 str. Termin realizacji zamówienia: ok. 5-8 dni roboczych. |

cena:

113,26 |

|

A Brief History of Taxation

ISBN: 9781905789023 / Angielski / Twarda / 140 str. Termin realizacji zamówienia: ok. 5-8 dni roboczych. This concise book on the development of the U.S. tax system traces taxation from the Ancient Egyptians through the Chinese, Indian, Ancient Greeks, Romans, Incas, Britons, United Kingdom, and the U.S. A quick overview of laws and the reasons behind their enactment is included.

This concise book on the development of the U.S. tax system traces taxation from the Ancient Egyptians through the Chinese, Indian, Ancient Greeks, Ro...

|

cena:

113,26 |

|

Liber Amicorum Sven-Olof Lodin: Modern Issues in the Law of International Taxation

ISBN: 9789041198501 / Angielski / Twarda / 342 str. Termin realizacji zamówienia: ok. 5-8 dni roboczych. |

cena:

1451,02 |

|

Modern Public Economics

ISBN: 9780415460118 / Angielski / Miękka / 624 str. Termin realizacji zamówienia: ok. 5-8 dni roboczych. In recent times not only have traditional areas of public economics such as taxation, public expenditure, public sector pricing, benefit cost analysis, and fiscal federalism thrown up new challenges but entirely new areas of research and inquiry have emerged. This second edition builds upon the strengths of the previous edition and incorporates results of research on new areas such as global public goods, environmental taxation and carbon permits trading and the complexities of corporate taxation in a rapidly globalizing world. The book is a modern and comprehensive... In recent times not only have traditional areas of public economics such as taxation, public expenditure, public sector pricing, benefit cost analy... |

cena:

365,03 |

|

Modern Public Economics

ISBN: 9780415460101 / Angielski / Twarda / 624 str. Termin realizacji zamówienia: ok. 5-8 dni roboczych. In recent times not only have traditional areas of public economics such as taxation, public expenditure, public sector pricing, benefit cost analysis, and fiscal federalism thrown up new challenges but entirely new areas of research and inquiry have emerged. This second edition builds upon the strengths of the previous edition and incorporates results of research on new areas such as global public goods, environmental taxation and carbon permits trading and the complexities of corporate taxation in a rapidly globalizing world. The book is a modern and comprehensive... In recent times not only have traditional areas of public economics such as taxation, public expenditure, public sector pricing, benefit cost analy... |

cena:

924,88 |

|

International Tax Coordination: An Interdisciplinary Perspective on Virtues and Pitfalls

ISBN: 9780415569484 / Angielski / Twarda / 224 str. Termin realizacji zamówienia: ok. 5-8 dni roboczych. International taxation is a major research topic, and for a field of research at the intersection of so many disciplines there has been surprisingly little done across disciplinary boundaries. This book fills the gap by combining teams from business, economics, information science, law and political science to offer a unique and innovative approach to the issue of international tax coordination. All the chapters are written in collaboration between at least two authors from two different disciplines. This approach offers a rich and nuanced understanding of the many issues of international... International taxation is a major research topic, and for a field of research at the intersection of so many disciplines there has been surprisingl... |

cena:

730,17 |

|

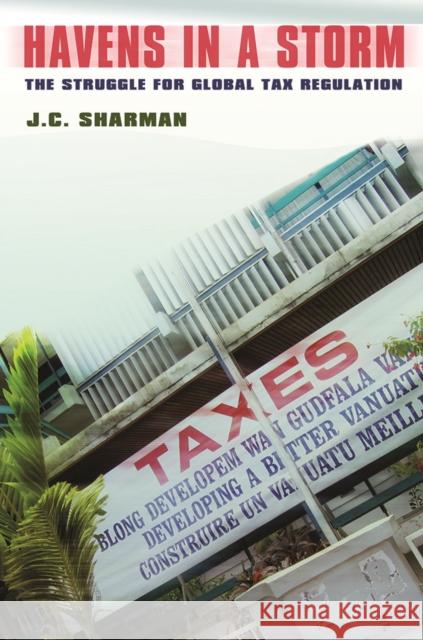

Havens in a Storm: The Struggle for Global Tax Regulation

ISBN: 9780801445040 / Angielski / Twarda / 224 str. Termin realizacji zamówienia: ok. 5-8 dni roboczych. Small states have learned in recent decades that capital accumulates where taxes are low; as a result, tax havens have increasingly competed for the attention of international investors with tax and regulatory concessions. Economically powerful countries including France, Britain, Japan, and the United States, however, wished to stanch the offshore flow of domestic taxable capital. Since 1998 the Organisation for Economic Co-operation and Development (OECD) has attempted to impose common tax regulations on more than three dozen small states. In a fascinating book based on fieldwork... Small states have learned in recent decades that capital accumulates where taxes are low; as a result, tax havens have increasingly competed for th... |

cena:

219,05 |

|

Tax Havens

ISBN: 9780801476129 / Angielski / Miękka / 280 str. Termin realizacji zamówienia: ok. 5-8 dni roboczych. From the Cayman Islands and the Isle of Man to the Principality of Liechtenstein and the state of Delaware, tax havens offer lower tax rates, less stringent regulations and enforcement, and promises of strict secrecy to individuals and corporations alike. In recent years government regulators, hoping to remedy economic crisis by diverting capital from hidden channels back into taxable view, have undertaken sustained and serious efforts to force tax havens into compliance. In Tax Havens, Ronen Palan, Richard Murphy, and Christian Chavagneux provide an up-to-date evaluation of... From the Cayman Islands and the Isle of Man to the Principality of Liechtenstein and the state of Delaware, tax havens offer lower tax rates, less ... |

cena:

97,30 |

|

Tax Justice and the Political Economy of Global Capitalism, 1945 to the Present

ISBN: 9780857458810 / Angielski / Twarda / 360 str. Termin realizacji zamówienia: ok. 5-8 dni roboczych. Tax "justice" has become an increasingly central issue of political debate in many countries, particularly following the cardiac arrest of global financial services in 2008 and the subsequent worldwide slump in trade and production. The evident abuse of tax systems by corporations and rich individuals through tax avoidance schemes and offshore shadow banking is increasingly in the public eye. Above all, the political challenges of recovery and structural reform have raised core issues of burden-sharing and social equity on the agendas of both civil society groups and political elites.... Tax "justice" has become an increasingly central issue of political debate in many countries, particularly following the cardiac arrest of global f... |

cena:

506,25 |

|

Malaysia@50: Economic Development, Distribution, Disparities

ISBN: 9789814571388 / Angielski / Twarda / 216 str. Termin realizacji zamówienia: ok. 5-8 dni roboczych. Malaysia has grown and changed a great deal since it was formed on 16 September 1963. It was then seen as an unlikely nation hastily put together as a federation of British controlled territories in the region. Brunei's refusal to join at the eleventh hour and Singapore's secession before its second birthday only seemed to confirm such doubts. Yet, it has not only survived, but even thrived, often cited as a developing country worthy of emulation. Ruled by the same ruling coalition since the mid-1950s, it has been tempting to emphasize continuities, and there certainly have been many. ...

Malaysia has grown and changed a great deal since it was formed on 16 September 1963. It was then seen as an unlikely nation hastily put together as a...

|

cena:

345,62 |

|

Lectures on Public Economics: Updated Edition

ISBN: 9780691166414 / Angielski / Twarda / 568 str. Termin realizacji zamówienia: ok. 5-8 dni roboczych. This classic introduction to public finance remains the best advanced-level textbook on the subject ever written. First published in 1980, Lectures on Public Economics still tops reading lists at many leading universities despite the fact that the book has been out of print for years. This new edition makes it readily available again to a new generation of students and practitioners in public economics. The lectures presented here examine the behavioral responses of households and firms to tax changes. Topics include the effects of taxation on labor supply, savings,... This classic introduction to public finance remains the best advanced-level textbook on the subject ever written. First published in 1980, Lectu... |

cena:

282,33 |