» książki » Business & Economics - Mergers & Acquisitions

|

Mega Mergers and Acquisitions: Case Studies from Key Industries

ISBN: 9781137005892 / Angielski / Twarda / 239 str. Termin realizacji zamówienia: ok. 5-8 dni roboczych. A casebook that discusses all the mega mergers and acquisitions in terms of value, that have happened in different industry sectors such as pharmacy, technology, telecommunications, media and entertainment, electrical and electronics, energy, finance, consumer goods, metals, and automobile and airlines.

A casebook that discusses all the mega mergers and acquisitions in terms of value, that have happened in different industry sectors such as pharmacy, ...

|

cena:

403,47 |

|

Handbook of Research on Mergers and Acquisitions

ISBN: 9781848449565 / Angielski / Twarda / 352 str. Termin realizacji zamówienia: ok. 5-8 dni roboczych. For the last four decades, researchers in various disciplines have been trying to explain the enduring paradox of the growing activity and volume of mergers and acquisitions (M&A) versus the high failure rate of M&A. This Handbook will stimulate scholars to focus on new research directions. The contributors explore how underlying concepts and methodologies can make an important contribution towards understanding M&A and their performance. This authoritative volume presents research that incorporates multidisciplinary, multi-level, multi-stage and cross-cultural models and analyses, and also...

For the last four decades, researchers in various disciplines have been trying to explain the enduring paradox of the growing activity and volume of m...

|

cena:

850,58 |

|

Perfect Your Exit Strategy: 7 Steps to Maximum Value

ISBN: 9780989839822 / Angielski / Miękka / 162 str. Termin realizacji zamówienia: ok. 5-8 dni roboczych. |

cena:

112,16 |

|

Diversification, Industry Dynamism, and Economic Performance: The Impact of Dynamic-Related Diversification on the Multi-Business Firm

ISBN: 9783658026769 / Angielski / Miękka / 348 str. Termin realizacji zamówienia: ok. 5-8 dni roboczych. The decision to diversify lies at the core of corporate strategy and is one of the most important decisions for top management. Matthias Knecht introduces a new perspective on corporate diversification that extends the academic discussion and reveals substantial new insights with regards to one of the most pressing questions in strategic management: what makes a diversification strategy successful? The author introduces the dynamism of industries as the dominant force in the firm's environment that influences the organization on all levels. Due to strategic, organizational, and...

The decision to diversify lies at the core of corporate strategy and is one of the most important decisions for top management. Matthias Knecht...

|

cena:

201,72 |

|

IT Mega Mergers - For the Pros: Information Technology Business Strategy Review

ISBN: 9781481105811 / Angielski / Miękka / 72 str. Termin realizacji zamówienia: ok. 5-8 dni roboczych. IT Mega Mergers - For the Pros In the mergers and acquisition environment, there are often significant productivity gains and cost reduction opportunities to be achieved with the Information Technology (IT) functions. These include: Combining the merged companies IT organizations and functions Assimilating the acquired company IT capabilities and requirements Within a large corporation, there may also be opportunities for significant productivity gains and cost reduction. These may involve: Evaluation of the in-place IT department and business functional organization IT structure,...

IT Mega Mergers - For the Pros In the mergers and acquisition environment, there are often significant productivity gains and cost reduction opportuni...

|

cena:

80,06 |

|

Intelligent M & A: Navigating the Mergers and Acquisitions Minefield

ISBN: 9781118764237 / Angielski / Twarda / 414 str. Termin realizacji zamówienia: ok. 5-8 dni roboczych. Almost 70% of mergers fail, yet deals are essential for growing world-class companies. Therefore they must use all the tools and techniques at their disposal to improve their chances of success. Applying the techniques advocated in this book can help managers beat the odds - and employees themselves - to have an impact on whether a deal will be successful both for the company and for themselves. This book looks at the process of a merger or acquisition and pinpoints the areas where business intelligence can raise the odds of success in each phase of the deal. Using techniques... Almost 70% of mergers fail, yet deals are essential for growing world-class companies. Therefore they must use all the tools and techniques at thei... |

cena:

141,24 |

|

The Art of M&A Structuring: Techniques for Mitigating Financial, Tax and Legal Risk

ISBN: 9780071410649 / Angielski / Twarda / 350 str. Termin realizacji zamówienia: ok. 5-8 dni roboczych. Real-world advice for determining the most advantageous structure in a merger, acquisition, or buyout The actual structuring of a merger or acquisition is key to the success of the entire procedure. The Art of M&A Structuring explores ways to approach a deal as an investment and satisfy the often conflicting financial and operational goals of all parties, from buyers and sellers to investors and lenders. Written in the trademark Q&A style that made The Art of M&A a landmark business bestseller, this book is filled with real-world examples and cases. Decision... Real-world advice for determining the most advantageous structure in a merger, acquisition, or buyout The actual structuring of a mer... |

cena:

279,01 |

|

Making M&A Deals Happen

ISBN: 9780071447409 / Angielski / Twarda / 312 str. Termin realizacji zamówienia: ok. 5-8 dni roboczych. Successfully Source, Negotiate, and Close Any Merger, Acquisition, or Joint Venture Making M&A Deals Happen provides a practical businessperson's approach to making M&A deals that withstand the test of time. The book presents complete guidance on how to source, negotiate, and close mergers, acquisitions, and joint ventures, discussing each stage of the deal process and highlighting the critical elements, risks, and opportunities of each. Bob Stefanowski, who has overseen more than $8.7 billion in M&A deals, equips readers with expert information on the M&A... Successfully Source, Negotiate, and Close Any Merger, Acquisition, or Joint Venture Making M&A Deals Happen provides a practic... |

cena:

305,76 |

|

The Art of M&A Integration 2nd Ed: A Guide to Merging Resources, Processes, and Responsibilties

ISBN: 9780071448109 / Angielski / Twarda / 450 str. Termin realizacji zamówienia: ok. 5-8 dni roboczych. Your roadmap to success in the world of postmerger integration Nearly half of today's executives attribute M&A failure to poor integration between merging businesses. This thoroughly revised edition of The Art of M&A Integration provides you with updated facts on integration of compensation plans, new FASB and GAAP accounting rules, strategies for merging IT systems and processes, and more. Your roadmap to success in the world of postmerger integration Nearly half of today's executives attribute M&A failure to poor integr... |

cena:

294,29 |

|

The Art of M&A Due Diligence, Second Edition: Navigating Critical Steps and Uncovering Crucial Data

ISBN: 9780071629362 / Angielski / Twarda / 480 str. Termin realizacji zamówienia: ok. 5-8 dni roboczych. The most trusted M&A guidebook available--updated for today's extreme-risk world of business.

Major financial scandals, geopolitical upheaval, technological advances, rapid globalization . . . The world--and the way business is done--has changed drastically in the 10 short years since the original publication of this book. As a result, the already tedious M&A process has become exponentially more complex. The most trusted guidebook of its kind, The Art of M&A Due Diligence helps you uncover problems and inconsistencies in an M&A deal while they're still manageable. You'll find... The most trusted M&A guidebook available--updated for today's extreme-risk world of business.

Major financial scandals, geopolitical upheaval, tech... |

cena:

582,70 |

|

The Art of M&A Strategy: A Guide to Building Your Company's Future Through Mergers, Acquisitions, and Divestitures

ISBN: 9780071756211 / Angielski / Twarda / 368 str. Termin realizacji zamówienia: ok. 5-8 dni roboczych. Seize the competitive advantage with today's most powerful strategic tool--M&A "Given the influence of technology, globalization, and regulatory change, M&A will continue to shape our industries. For most companies, therefore, the consideration of M&A in strategy is now fundamental." The Art of M&A Strategy is exactly what you need to build mergers, acquisitions, and divestitures into your overall business strategy--to make M&A a competitive advantage and avoid landing on the long list of M&A failures. Experts... Seize the competitive advantage with today's most powerful strategic tool--M&A "Given the influence of technology, globalization, ... |

cena:

393,82 |

|

Mergers and Acquisitions Strategy for Consolidations: Roll Up, Roll Out and Innovate for Superior Growth and Returns

ISBN: 9780071793421 / Angielski / Twarda / 320 str. Termin realizacji zamówienia: ok. 5-8 dni roboczych. THE NEW M&A STRATEGY FOR LONG-TERM SUCCESS IN TODAY'S VOLATILE MARKETS

"Rich in examples and details, well-grounded in wisdom from years of experience, and blessedly practical . . . . engaging, well-written, and loaded with worthy insights. Study this book and prosper." -- DR. ROBERT B RUNER, Dean, University of Virginia's Darden School of Business, and author of Deals from Hell, The Panic of 1907, and Applied Mergers & Acquisitions. "Drawing on his experience with more than 100 M&A transactions, Hoffmann has written a defi nitive 'how-to' for acquiring... THE NEW M&A STRATEGY FOR LONG-TERM SUCCESS IN TODAY'S VOLATILE MARKETS

"Rich in examples and details, well-grounded in wisdom from years of expe... |

cena:

393,82 |

|

Art of M&A Valuation and Modeling: A Guide to Corporate Valuation

ISBN: 9780071805377 / Angielski / Twarda / 304 str. Termin realizacji zamówienia: ok. 5-8 dni roboczych. Valuation is not just a critical step in buying or selling a company, it's an instrumental tool for measuring and managing the successful growth of any business. If you are an advisor, investor, business owner, or board member, this comprehensive guide from the authors of the bestselling "Art of M&A" series provides the essential information you need to: * Master the fundamentals of business valuation Valuation is not just a critical step in buying or selling a company, it's an instrumental tool for measuring and managing the successful growth of... |

cena:

524,92 |

|

The Warren Buffett Philosophy of Investment: How a Combination of Value Investing and Smart Acquisitions Drives Extraordinary Success

ISBN: 9780071819329 / Angielski / Twarda / 336 str. Termin realizacji zamówienia: ok. 5-8 dni roboczych. See the world's #1 investor like never before--and learn how you can replicate his success Many books have been written about Warren Buffett's value-investing strategy, and volumes more have been written about becoming a top-tier value investor. Even so, no one can touch the success Warren Buffett has achieved. Why? In this revealing examination of Buffett's success, practitioner, professor, and bestselling author Еlena Chirkova proposes the key to replicating his achievements is found in his acquisition practices as well as his investment strategy. In The... See the world's #1 investor like never before--and learn how you can replicate his success Many books have been written about Warren ... |

cena:

152,88 |

|

Mergers and Acquisitions Basics: Negotiation and Deal Structuring

ISBN: 9780123749499 / Angielski / Miękka / 225 str. Termin realizacji zamówienia: ok. 5-8 dni roboczych. Negotiations form the heart of mergers and acquisitions efforts, for their conclusions contain both anticipated and unforeseen implications. Don DePamphilis presents a summary of negotiating and deal structuring that captures its dynamic process, showing readers how brokers, bankers, accountants, attorneys, tax experts, managers, investors, and others must work together and what happens when they don't. Writtten for those who seek a broadly-based view of M&A and understand their own roles in the process, this book treads a middle ground between highly technical and dumbed-down descriptions... Negotiations form the heart of mergers and acquisitions efforts, for their conclusions contain both anticipated and unforeseen implications. Don De... |

cena:

165,46 |

|

The Handbook of Mergers and Acquisitions

ISBN: 9780199601462 / Angielski / Twarda / 632 str. Termin realizacji zamówienia: ok. 5-8 dni roboczych. With its inception at the end of the nineteenth century as a means of consolidation and reorganization, mergers and acquisitions (M&A) have since become quasi-institutionalized as one of the primary strategic options for organizations, as they seek to secure their position in an ever more competitive and globalizing market place. Despite the optimism surrounding M&A as strategic moves, research on post-merger company performance suggests that most firms engaging in M&A activity do not achieve the sought-after performance targets, either immediately or in the years following the deal. What is...

With its inception at the end of the nineteenth century as a means of consolidation and reorganization, mergers and acquisitions (M&A) have since beco...

|

cena:

686,51 |

|

Letting Go: Preparing Yourself to Relinquish Control of the Family Business

ISBN: 9780230111158 / Angielski / Miękka / 94 str. Termin realizacji zamówienia: ok. 5-8 dni roboczych. Letting Go helps family business owners and CEOs make the decision to begin succession planning. It provides new ways of thinking about giving up control of the family business and explores practical strategies for preparing, managing, and carrying out the decision to do so.

Letting Go helps family business owners and CEOs make the decision to begin succession planning. It provides new ways of thinking about giving up cont...

|

cena:

112,95 |

|

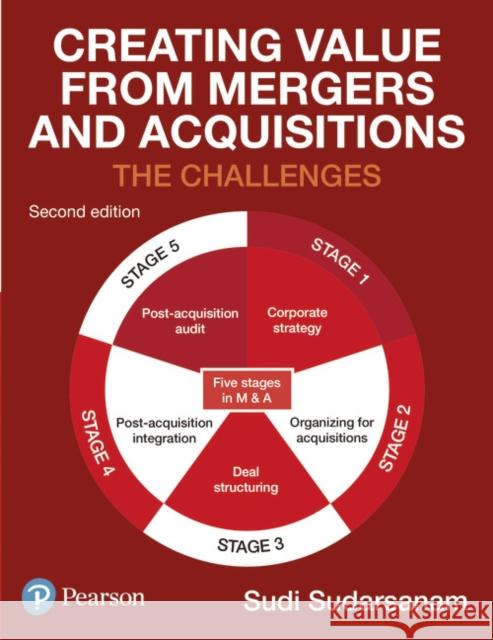

Creating Value from Mergers and Acquisitions: The Challenges

ISBN: 9780273715399 / Angielski / Miękka / 816 str. Termin realizacji zamówienia: ok. 5-8 dni roboczych. Creating Value from Mergers and Acquisitions is the first book to provide a comparative analysis of the M&A scene in Europe and the US, the two most active markets in the world. Now in its second edition it continues to develop an international and multidisciplinary perspective of M&A, and considers M&A as a process and not a mere transaction. The author draws upon economics, finance, strategy, law, organisational theories to formulate a five-stage model and emphasises the need to understand the interconnected nature of these stages. The book's central focus in on the challenges to using M&A...

Creating Value from Mergers and Acquisitions is the first book to provide a comparative analysis of the M&A scene in Europe and the US, the two most a...

|

cena:

511,91 |

|

Principles of Equity Valuation

ISBN: 9780415696036 / Angielski / Miękka / 312 str. Termin realizacji zamówienia: ok. 5-8 dni roboczych. The book provides a rigorous introduction to corporate finance and the valuation of equity. The first half of the book covers much of the received theory in these areas such as the relationship between the risk of an equity security and the return one can expect from it, the effects of leverage (that is, the borrowing policies of the firm) on the return one can expect from the firm's shares and the role that dividends, operating cash flows and accounting earnings play in the valuation of equity. The second half of the book is more advanced and deals with the important role that "real options"...

The book provides a rigorous introduction to corporate finance and the valuation of equity. The first half of the book covers much of the received the...

|

cena:

438,05 |

|

M&A Titans: The Pioneers Who Shaped Wall Street's Mergers and Acquisitions Industry

ISBN: 9780470126899 / Angielski / Twarda / 240 str. Termin realizacji zamówienia: ok. 5-8 dni roboczych. This book focuses on the 11 men, lawyers and bankers, who are responsible for the creation of Wall Street's merger industry. It specifically concentrates on the events and personalities who dominated Wall Street during the takeover battles of the 1970s and 1980s. Lawyers Joe Flom and Marty Lipton, the godfathers of modern M&A, educated bankers on takeover laws and regulations as well as tactics. Flom and Lipton were also superlative businessmen who built their own firms to become Wall Street powerhouses. The two men drew into their orbit a circle of bankers. Felix Rohatyn, Ira Harris, Steve...

This book focuses on the 11 men, lawyers and bankers, who are responsible for the creation of Wall Street's merger industry. It specifically concentra...

|

cena:

122,30 |