Wyniki wyszukiwania:

wyszukanych pozycji: 9

|

The Jews in Nineteenth-Century France: From the French Revolution to the Alliance Israélite Universelle

ISBN: 9780804725712 / Angielski / Twarda / 1996 / 352 str. Termin realizacji zamówienia: ok. 30 dni roboczych. This work on the history of French Jewry, follows the reshaping of Franco-Jewish identity from legal emancipation after the French Revolution, through to the creation in 1860 of the Alliance Israelite Universelle, the first international Jewish organization devoted to the struggle for Jewish rights throughout the world.

This work on the history of French Jewry, follows the reshaping of Franco-Jewish identity from legal emancipation after the French Revolution, through...

|

cena:

316,65 |

|

Death by a Thousand Cuts: The Fight Over Taxing Inherited Wealth

ISBN: 9780691127897 / Angielski / Miękka / 2006 / 392 str. Termin realizacji zamówienia: ok. 30 dni roboczych. This fast-paced book by Yale professors Michael Graetz and Ian Shapiro unravels the following mystery: How is it that the estate tax, which has been on the books continuously since 1916 and is paid by only the wealthiest two percent of Americans, was repealed in 2001 with broad bipartisan support? The mystery is all the more striking because the repeal was not done in the dead of night, like a congressional pay raise. It came at the end of a multiyear populist campaign launched by a few individuals, and was heralded by its supporters as a signal achievement for Americans who are committed... This fast-paced book by Yale professors Michael Graetz and Ian Shapiro unravels the following mystery: How is it that the estate tax, which has bee... |

cena:

173,17 |

|

Follow the Money

ISBN: 9780692630143 / Angielski / Miękka / 2016 / 536 str. Termin realizacji zamówienia: ok. 16-18 dni roboczych. Publicity about tax avoidance techniques of multinational corporations and wealthy individuals has moved discussion of international income taxation from the backrooms of law and accounting firms to the front pages of news organizations around the world. In the words of a top Australian tax official, international tax law has now become a topic of barbeque conversations. Public anger has, in turn, brought previously arcane issues of international taxation onto the agenda of heads of government around the world. Despite all the attention, however, issues of international income taxation are...

Publicity about tax avoidance techniques of multinational corporations and wealthy individuals has moved discussion of international income taxation f...

|

cena:

71,93 |

|

The Power to Destroy: How the Antitax Movement Hijacked America

ISBN: 9780691225548 / Angielski / Twarda / 2024 / 384 str. Termin realizacji zamówienia: ok. 16-18 dni roboczych. |

cena:

116,98 |

|

True Security: Rethinking American Social Insurance

ISBN: 9780300081947 / Angielski / Miękka / 1999 / 384 str. Termin realizacji zamówienia: ok. 16-18 dni roboczych. Social insurance in the United States--including the Social Security Act of 1935 and the Medicare, Medicaid, and disability insurance programs that were added later--may be the greatest triumph of American domestic policy. But true security has not been achieved. As Michael J. Graetz and Jerry L. Mashaw show in this pathbreaking book, the nation's system of social insurance is riddled with gaps, inefficiencies, and inequities. Even the most popular and successful programs, Medicare and Social Security, face serious financial challenges from the coming retirement of the baby boom generation... Social insurance in the United States--including the Social Security Act of 1935 and the Medicare, Medicaid, and disability insurance programs that... |

cena:

268,78 |

|

100 Million Unnecessary Returns: A Simple, Fair, and Competitive Tax Plan for the United States

ISBN: 9780300164572 / Angielski / Miękka / 2010 / 288 str. Termin realizacji zamówienia: ok. 16-18 dni roboczych. To most Americans, the United States tax code has become a vast and confounding puzzle. Graetz, one of the world's leading tax policy experts, offers "the most interesting tax] plan I've seen" (David Ignatius, Washington Post). Now in paperback, his plan would eliminate the income tax for most Americans and replace it with a value-added tax that would be levied on goods at each stage of exchange, from the producer to the consumer.

To most Americans, the United States tax code has become a vast and confounding puzzle. Graetz, one of the world's leading tax policy experts, offers ...

|

cena:

219,57 |

|

The Power to Destroy: How the Antitax Movement Hijacked America

ISBN: 9780691225562 / Angielski Termin realizacji zamówienia: ok. 16-18 dni roboczych. |

cena:

89,64 |

|

The Wolf at the Door: The Menace of Economic Insecurity and How to Fight It

ISBN: 9780674260429 / Angielski / Miękka / 2021 / 368 str. Termin realizacji zamówienia: ok. 30 dni roboczych. |

cena:

93,48 |

|

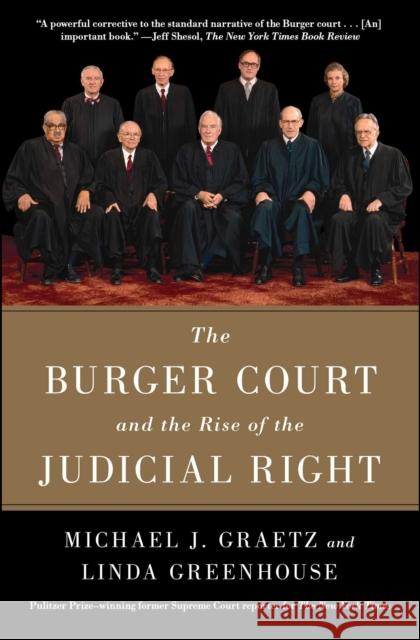

The Burger Court and the Rise of the Judicial Right

ISBN: 9781476732510 / Angielski / Miękka / 2017 / 480 str. Termin realizacji zamówienia: ok. 16-18 dni roboczych. A revelatory look at the Warren Burger Supreme Court finds that it was not moderate or transitional, but conservative--and it shaped today's constitutional landscape. It is an "important book...a powerful corrective to the standard narrative of the Burger Court" (The New York Times Book Review). When Richard Nixon campaigned for the presidency in 1968 he promised to change the Supreme Court. With four appointments to the court, including Warren E. Burger as the chief justice, he did just that. In 1969, the Burger Court succeeded the famously liberal Warren Court, which had...

A revelatory look at the Warren Burger Supreme Court finds that it was not moderate or transitional, but conservative--and it shaped today's constitut...

|

cena:

152,29 |