Wyniki wyszukiwania:

wyszukanych pozycji: 28

|

Urban Monsters: Three Tales Of Present-Day Mythology

ISBN: 9798841251705 / Angielski / Miękka / 2022 / 64 str. Termin realizacji zamówienia: ok. 16-18 dni roboczych. |

cena:

41,79 |

|

Empress Of The Living Dead: 25 Tales Of Horror & The Bizarre

ISBN: 9781798060438 / Angielski / Miękka / 2019 / 194 str. Termin realizacji zamówienia: ok. 16-18 dni roboczych. |

cena:

63,48 |

|

Skiing at Lake Tahoe

ISBN: 9781531659868 / Angielski / Twarda / 2012 / 130 str. Termin realizacji zamówienia: ok. 16-18 dni roboczych. Organized ski racing in America started near Lake Tahoe in the 1860s when gold miners rode 15-foot boards that reached speeds near 100 miles per hour. By 1895, residents of Truckee had started the nations first winter carnival west of the Rocky Mountains and soon built the largest ski jump in California. Todays Lake Tahoe, with significant annual snowfall, has become home to the largest concentration of ski resorts on the continent. Places like Mount Rose, Squaw Valley (home of the 1960 Winter Olympics), Sugar Bowl, Heavenly Valley, Homewood, Sierra-at-Tahoe, Alpine Meadows, Kirkwood, Diamond...

Organized ski racing in America started near Lake Tahoe in the 1860s when gold miners rode 15-foot boards that reached speeds near 100 miles per hour....

|

cena:

121,25 |

|

Injectables: A Novel Of Lovecraftian Horror

ISBN: 9798691117558 / Angielski / Miękka / 2020 / 146 str. Termin realizacji zamówienia: ok. 16-18 dni roboczych. |

cena:

51,54 |

|

Umbra Sapiens & Other Lurking Life-Forms

ISBN: 9798838846655 / Angielski / Miękka / 2022 / 62 str. Termin realizacji zamówienia: ok. 16-18 dni roboczych. |

cena:

40,79 |

|

Human Doll

ISBN: 9798628365731 / Angielski / Miękka / 2020 / 150 str. Termin realizacji zamówienia: ok. 16-18 dni roboczych. |

cena:

51,54 |

|

Embrace Of The Internet Witch: Poems Of Dark Wonder

ISBN: 9798360203247 / Angielski / Miękka / 2022 / 78 str. Termin realizacji zamówienia: ok. 16-18 dni roboczych. |

cena:

41,79 |

|

The Hell Next Door

ISBN: 9798667919605 / Angielski / Miękka / 2020 / 154 str. Termin realizacji zamówienia: ok. 16-18 dni roboczych. |

cena:

51,54 |

|

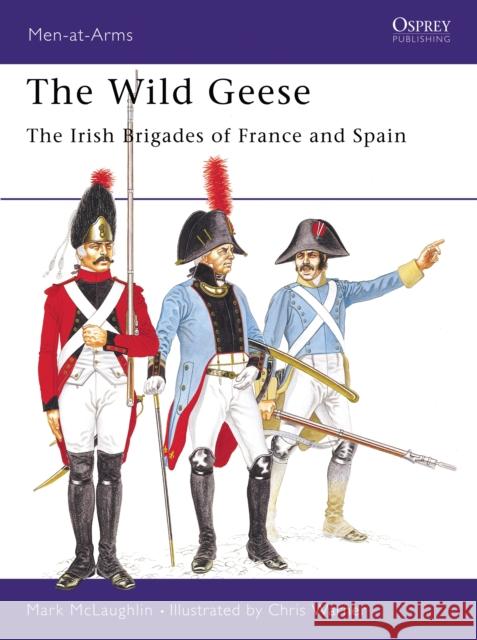

The Wild Geese: The Irish Brigades of France and Spain

ISBN: 9780850453584 / Angielski / Miękka / 1980 / 48 str. Termin realizacji zamówienia: ok. 30 dni roboczych. In the early years of the English Civil War (1642-1651), a French traveller in England remarked that the Irish "are better soldiers abroad than at home." Between 1585 and 1818, over half a million Irish were lured from their homeland by promises of glory, money and honour in a constant emigration romantically styled "The Flight of the Wild Geese." Throughout this period, the Irish brigades in France and Spain participated in conflicts ranging from the wars of the Spanish and Austrian Succession (1701-1714 and 1740-1748 respectively) to the Napoleonic Wars (1799-1815). Spanning over two...

In the early years of the English Civil War (1642-1651), a French traveller in England remarked that the Irish "are better soldiers abroad than at hom...

|

cena:

66,70 |

|

The Prisoner Of Carcosa & More Tales Of The Bizarre

ISBN: 9781659240719 / Angielski / Miękka / 2020 / 134 str. Termin realizacji zamówienia: ok. 16-18 dni roboczych. |

cena:

42,79 |

|

Time for Wisdom: Knowledge, Detachment, Tranquility, Transcendence

ISBN: 9781599475875 / Angielski / Twarda / 2022 / 256 str. Termin realizacji zamówienia: ok. 22 dni roboczych. These are volatile times. Fear, suspicion, and cynicism are chronic. A mere tweet inflames the passions of millions while click-bait “hot takes” stoke the amygdalas of everyone with an Internet connection. We treat those not in our tribe as a threat and deem anyone with a different opinion as evil. Mistaking myopia for measure, we lack all sense of proportion in our judgments. We are shortsighted, mired in the present, ignorant of history, and blind to the future. We thought that technology would save us by connecting us to each other and the world’s... These are volatile times. Fear, suspicion, and cynicism are chronic. A mere tweet inflames the passions of millions while click-... |

cena:

107,26 |

|

Dimension Of Monsters: Creatures, Possession & Lovecraftian Horror

ISBN: 9798832598789 / Angielski / Miękka / 84 str. Termin realizacji zamówienia: ok. 16-18 dni roboczych. |

cena:

41,79 |

|

The Spiderweb Tree

ISBN: 9798838983916 / Angielski / Miękka / 60 str. Termin realizacji zamówienia: ok. 16-18 dni roboczych. |

cena:

40,79 |

|

Crushed Velvet: Poems Of Horror & Beauty

ISBN: 9798354871872 / Angielski / Miękka / 86 str. Termin realizacji zamówienia: ok. 16-18 dni roboczych. |

cena:

40,79 |

|

Horrors & Abominations: 24 Tales Of The Cthulhu Mythos

ISBN: 9781791560522 / Angielski / Miękka / 2018 / 250 str. Termin realizacji zamówienia: ok. 16-18 dni roboczych. |

cena:

67,46 |

|

City Of Living Shadows & More Lovecraftian Tales

ISBN: 9781687570772 / Angielski / Miękka / 2019 / 122 str. Termin realizacji zamówienia: ok. 16-18 dni roboczych. |

cena:

55,72 |

|

Cognitive Dominance: A Brain Surgeon's Quest to Out-Think Fear

ISBN: 9781936891627 / Angielski / Miękka / 2019 / 352 str. Termin realizacji zamówienia: ok. 16-18 dni roboczych. |

cena:

94,57 |

|

The House Of The Ocelot & More Lovecraftian Nightmares

ISBN: 9781795518369 / Angielski / Miękka / 2019 / 220 str. Termin realizacji zamówienia: ok. 16-18 dni roboczych. |

cena:

63,48 |

|

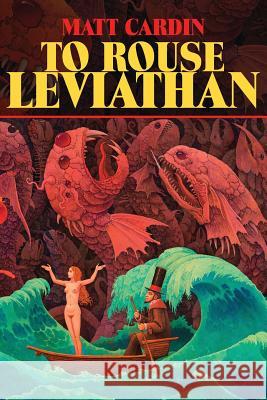

To Rouse Leviathan

ISBN: 9781614982708 / Angielski / Miękka / 2019 / 376 str. Termin realizacji zamówienia: ok. 16-18 dni roboczych. |

cena:

106,13 |

|

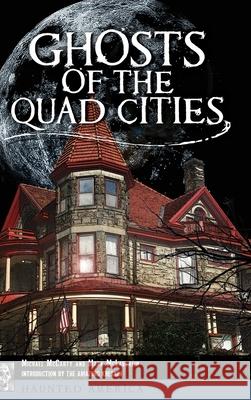

Ghosts of the Quad Cities

ISBN: 9781540240521 / Angielski / Twarda / 2019 / 114 str. Termin realizacji zamówienia: ok. 16-18 dni roboczych. |

cena:

121,25 |