It's Our Children's Default, Stupid » książka

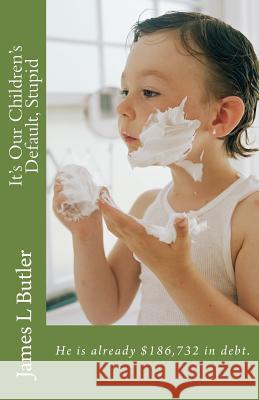

It's Our Children's Default, Stupid

ISBN-13: 9781497504288 / Angielski / Miękka / 2014 / 100 str.

This book steps through the development of the three key ingredients to the financial crisis in the United States; Fiscal policy that depends on and encourages massive expansion of private debt to generate economic activity, a cultural acceptance of using debt to achieve a higher standard of living by the Baby Boomer generation and a glorification of debt by commercial financial institutions using slick marketing campaigns and creating new debt products to fit every desire. Operating under this recipe for the last fifty years has left an entire generation, the Baby Boomers, facing financial disaster as they move into their retirement years and left the U.S. economy vulnerable to any weakness in any segment. Every debt segment continues to grow exponentially, exceeding the record levels set in 2007, bringing total debt in the U.S. economy to near $60 trillion. How did we get here? Where are we headed? This is for the 80-90% of Americans who have little or no financial education. Most of what is written, reported and discussed about the status of the United States Economy is filled with a lot of finance industry jargon and technical information intended for people either in the finance industry or following it closely. It is often presented by one expert on the economy as a disagreement with another expert on the economy; not very helpful to the average working person. But the average working person can no longer afford to be ignorant and trusting of the actions impacting their future and their children's future. It is not entirely accidental that the experts keep the general population confused and in the dark about what is really happening though. "It is well enough that people of the nation do not understand our banking and money system, for if they did, I believe there would be a revolution before tomorrow morning." Henry Ford, founder of the Ford Motor Company.

Zawartość książki może nie spełniać oczekiwań – reklamacje nie obejmują treści, która mogła nie być redakcyjnie ani merytorycznie opracowana.