» książki » Law - Taxation

|

The Myth of Ownership: Taxes and Justice

ISBN: 9780195176568 / Angielski / Miękka / 228 str. Termin realizacji zamówienia: ok. 5-8 dni roboczych. In a capitalist economy, taxes are the most important instrument by which the political system puts into practice a conception of economic and distributive justice. Taxes arouse strong passions, fueled not only by conflicts of economic self-interest, but by conflicting ideas of fairness. Taking as a guiding principle the conventional nature of private property, Murphy and Nagel show how taxes can only be evaluated as part of the overall system of property rights that they help to create. Justice or injustice in taxation, they argue, can only mean justice or injustice in the system of property...

In a capitalist economy, taxes are the most important instrument by which the political system puts into practice a conception of economic and distrib...

|

cena:

175,61 |

|

Antitrust and the Formation of the Postwar World

ISBN: 9780231123990 / Angielski / Miękka / 240 str. Termin realizacji zamówienia: ok. 5-8 dni roboczych. Today antitrust law shapes the policy of almost every large company, no matter where headquartered. But this wasn't always the case. Before World War II, the laws of most industrial countries tolerated and even encouraged cartels, whereas American statutes banned them. In the wake of World War II, the United States devoted considerable resources to building a liberal economic order, which Washington believed was necessary to preserving not only prosperity but also peace after the war. Antitrust was a cornerstone of that policy. This fascinating book shows how the United States sought to...

Today antitrust law shapes the policy of almost every large company, no matter where headquartered. But this wasn't always the case. Before World War ...

|

cena:

200,52 |

|

Federal Estate and Gift Taxes

ISBN: 9780313222924 / Angielski / Twarda / 253 str. Termin realizacji zamówienia: ok. 5-8 dni roboczych. To clarify the issues in estate and gift taxation, a conference was held at the Brookings Institution where a group of experts reviewed the major controversial issues, analyzed the provisions of the present law, and clarified differences of opinion on this part of the tax system.

To clarify the issues in estate and gift taxation, a conference was held at the Brookings Institution where a group of experts reviewed the major c... |

cena:

381,51 |

|

Forging Legislation

ISBN: 9780393960716 / Angielski / Miękka / 288 str. Termin realizacji zamówienia: ok. 5-8 dni roboczych. |

cena:

100,00 |

|

Residential Property Appraisal

ISBN: 9780419225706 / Angielski / Miękka / 368 str. Termin realizacji zamówienia: ok. 5-8 dni roboczych. This is a practitioner handbook for surveyors involved in the appraisal of residential property for lending purposes. Thus, it focuses on the distinct professional roles required by Mortgage Valuations (MVs) amd Home Buyers Surveys and Valuations (HBSVs), identifying and advertising the reader on the extent and limitations of their activities. It is illustrated and supported by real-life case studies and drawings on late-1990s research, professional and legal developments.

This is a practitioner handbook for surveyors involved in the appraisal of residential property for lending purposes. Thus, it focuses on the distinct...

|

cena:

279,12 |

|

Intermediate Sanctions: Curbing Nonprofit Abuse

ISBN: 9780471174561 / Angielski / Miękka / 208 str. Termin realizacji zamówienia: ok. 5-8 dni roboczych. What are the requirements of the new intermediate sanctions law?

What is the definition of an excess benefit transaction? How will financial penalties be determined? How will sanctions be applied? What are the law's expanded reporting and disclosure requirements? What can nonprofits do to plan for compliance? These are just some of the questions you may be asking about intermediate sanctions, the most important legislation to impact the nonprofit sector in a generation. This unique guide tackles these crucial issues... What are the requirements of the new intermediate sanctions law?

What is the definition of an excess benefit transaction? Ho... |

cena:

592,88 |

|

Construction Claims : Prevention and Resolution

ISBN: 9780471348634 / Angielski / Twarda / 416 str. Termin realizacji zamówienia: ok. 5-8 dni roboczych. Praise for the Second Edition . . .

"A basic, how-to guide . . . for all those involved in the construction industry."--The Construction Lawyer "This book is indispensable for any contractor who, against his better judgment, bids a fixed price contract . . . highly recommended."--David S. Thaler, The Daily Record "Particularly useful to the construction contractor and] also instructive to owners and design professionals."--Journal of Performance of Constructed Facilities "Practical advice on how to prevent a dispute--from the moment that... Praise for the Second Edition . . .

"A basic, how-to guide . . . for all those involved in the construction industry."--The Construction ... |

cena:

623,55 |

|

Sarbanes-Oxley and the New Internal Auditing Rules

ISBN: 9780471483069 / Angielski / Twarda / 336 str. Termin realizacji zamówienia: ok. 5-8 dni roboczych. Sarbanes-Oxley and the New Internal Auditing Rules thoroughly and clearly explains the Sarbanes-Oxley Act, how it impacts auditors, and how internal auditing can help with its requirements, such as launching an ethics and whistle-blower program or performing effective internal controls reviews under the COSO framework. With ample coverage of emerging rules that have yet to be issued and other matters subject to change, this book outlines fundamental blueprints of the new rules, technological developments, and evolving trends that impact internal audit professionals.

Order your copy... Sarbanes-Oxley and the New Internal Auditing Rules thoroughly and clearly explains the Sarbanes-Oxley Act, how it impacts auditors, and how int...

|

cena:

335,11 |

|

Law and Internet Cultures

ISBN: 9780521600484 / Angielski / Miękka / 252 str. Termin realizacji zamówienia: ok. 5-8 dni roboczych. This book is about the Internet and the technological and cultural baggage that accompanies it and affects its regulation. It considers the ways decisions about Internet technologies are made; ideas behind global trade and innovation; power of engineers and programmers; influence of multinationals; and questions about global marketing and consumer choice. Although the volume draws upon current debates from globalization, communications and socio-legal theory, it will be comprehensible to a general audience interested in issues associated with technology and innovation.

This book is about the Internet and the technological and cultural baggage that accompanies it and affects its regulation. It considers the ways decis...

|

cena:

145,50 |

|

International Tax as International Law: An Analysis of the International Tax Regime

ISBN: 9780521618014 / Angielski / Miękka / 224 str. Termin realizacji zamówienia: ok. 5-8 dni roboczych. This book explains how the tax rules of the various countries in the world interact with one another to form an international tax regime: a set of principles embodied in both domestic legislation and treaties that significantly limits the ability of countries to choose any tax rules they please. The growth of this international tax regime is an important part of the phenomenon of globalization, and the book delves into how tax revenues are divided among different countries. It also explains how U.S. tax rules in particular apply to cross-border transactions and how they embody the norms of...

This book explains how the tax rules of the various countries in the world interact with one another to form an international tax regime: a set of pri...

|

cena:

196,54 |

|

Antitrust Law: Economic Theory and Common Law Evolution

ISBN: 9780521790314 / Angielski / Twarda / 430 str. Termin realizacji zamówienia: ok. 5-8 dni roboczych. This book consolidates several different perspectives on antitrust law. First, Keith Hylton presents a detailed description of the law as it has developed through numerous judicial opinions. Second, he presents detailed economic critiques of the judicial opinions, drawing heavily from law and economics journals. Third, he integrates a jurisprudential perspective that views antitrust as a vibrant field of common law. This last perspective leads him to address issues of certainty, stability, and predictability in antitrust law, and to examine the pressures shaping its evolution.

This book consolidates several different perspectives on antitrust law. First, Keith Hylton presents a detailed description of the law as it has devel...

|

cena:

345,02 |

|

International Tax as International Law: An Analysis of the International Tax Regime

ISBN: 9780521852838 / Angielski / Twarda / 224 str. Termin realizacji zamówienia: ok. 5-8 dni roboczych. This book explains how the tax rules of the various countries in the world interact with one another to form an international tax regime: a set of principles embodied in both domestic legislation and treaties that significantly limits the ability of countries to choose any tax rules they please. The growth of this international tax regime is an important part of the phenomenon of globalization, and the book delves into how tax revenues are divided among different countries. It also explains how U.S. tax rules in particular apply to cross-border transactions and how they embody the norms of...

This book explains how the tax rules of the various countries in the world interact with one another to form an international tax regime: a set of pri...

|

cena:

345,02 |

|

Income Tax in Common Law Jurisdictions: Volume 1, from the Origins to 1820

ISBN: 9780521870832 / Angielski / Twarda / 594 str. Termin realizacji zamówienia: ok. 5-8 dni roboczych. This book was first published in 2006. Many common law countries inherited British income tax rules. Whether the inheritance was direct or indirect, the rationale and origins of some of the central rules seem almost lost in history. Commonly, they are simply explained as being of British origin without more, but even in Britain the origins of some of these rules are less than clear. This book traces the roots of the income tax and its precursors in Britain and in its former colonies to 1820. Harris focuses on four issues that are central to common law income taxes and which are of particular...

This book was first published in 2006. Many common law countries inherited British income tax rules. Whether the inheritance was direct or indirect, t...

|

cena:

632,70 |

|

The Short Book on the Offer in Compromise, IRS Liens and Levies!

ISBN: 9780595316830 / Angielski / Miękka / 60 str. Termin realizacji zamówienia: ok. 5-8 dni roboczych. This is what Patrick M. Ryan, tax law specialist, can do for you:

To get started, call Pat Ryan at 866-286-2241 or... This is what Patrick M. Ryan, tax law specialist, can do for you:

|

cena:

38,35 |

|

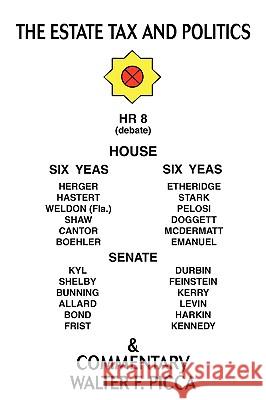

The Estate Tax and Politics

ISBN: 9780595421893 / Angielski / Miękka / 64 str. Termin realizacji zamówienia: ok. 5-8 dni roboczych. This book is an explanation-or analysis of the estate tax called-the "Death Tax"-its many changes, quotes from various people, including excerpts from members of the House and Senate, which debated HR 8-its repeal. It includes a commentary on those debates-and HR 5638, the estate tax relief act. It also includes suggestions on how to reform it.

This book is an explanation-or analysis of the estate tax called-the "Death Tax"-its many changes, quotes from various people, including excerpts from...

|

cena:

38,35 |

|

Those Dirty Rotten Taxes: The Tax Revolts That Built America

ISBN: 9780684871141 / Angielski / Miękka / 256 str. Termin realizacji zamówienia: ok. 5-8 dni roboczych. In 1798, after Congress had passed its first direct tax on houses, the government cooked up a scheme to count and measure the windows on every taxpayer's house, in order to calculate how much to charge. But German settlers in eastern Pennsylvania would have none of it. They organized into small bands, armed themselves, and scoured the countryside for assessors who were seized, assaulted, and driven across county lines. When some of the rebels were arrested, an auctioneer named John Fries marched on the courthouse and freed them. President John Adams called out the militia. Fries was arrested,...

In 1798, after Congress had passed its first direct tax on houses, the government cooked up a scheme to count and measure the windows on every taxpaye...

|

cena:

73,03 |

|

Military Justice in Vietnam: The Rule of Law in an American War

ISBN: 9780700614608 / Angielski / Twarda / 248 str. Termin realizacji zamówienia: ok. 5-8 dni roboczych. The My Lai Massacre was the most publicized incident subjected to military law during the Vietnam War, but military lawyers in all the service branches had their hands full with less-publicized desertions, drug use, rapes, fraggings, black marketeering, and even small claims. William Allison reveals how the military justice system responded to crimes and infractions both inside and outside the combat zone and how it adapted to an unconventional political, military, and social climate as American involvement escalated. In taking readers to war-torn Vietnam, Allison's study depicts a...

The My Lai Massacre was the most publicized incident subjected to military law during the Vietnam War, but military lawyers in all the service branche...

|

cena:

225,30 |

|

Antitrust Law and Economics

ISBN: 9780762311156 / Angielski / Twarda / 504 str. Termin realizacji zamówienia: ok. 5-8 dni roboczych. This title provides a collection of papers by prominent authors examining antitrust issues of current interest.

This title provides a collection of papers by prominent authors examining antitrust issues of current interest.

|

cena:

1173,61 |

|

Justifying Taxes: Some Elements for a General Theory of Democratic Tax Law

ISBN: 9780792370529 / Angielski / Twarda / 366 str. Termin realizacji zamówienia: ok. 5-8 dni roboczych. Justifying Taxes offers readers some of the elements of a democratic tax law, considered within its political and philosophical context in order to determine the extent of legitimate tax obligations. The objective is to revisit some of the issues in the dogmatics of tax law from the viewpoint of a critical citizen, always ready to ask questions about the justification underlying her obligations, and especially about her paramount burden, viz., the payment of certain amounts of money. Within this purview, special attention is paid to the general principles of taxation.

... Justifying Taxes offers readers some of the elements of a democratic tax law, considered within its political and philosophical context in or...

|

cena:

805,10 |

|

Property Tax Reform in Developing Countries

ISBN: 9780792380955 / Angielski / Twarda / 213 str. Termin realizacji zamówienia: ok. 5-8 dni roboczych. Property Tax Reform in Developing Countries provides a conceptual framework for property tax reform with the intention of making the most compelling argument possible to persuade the reader as to its validity. The text claims that a model for property tax reform in developing countries is derived from a theoretical distillation of empirical experience. The primary objective of this study is to establish, through logic, theory and observation: what constitutes a good property tax system, for whom, and under what conditions; why such a system works; and how inferior systems can be...

Property Tax Reform in Developing Countries provides a conceptual framework for property tax reform with the intention of making the most com...

|

cena:

603,81 |