» książki » Business & Economics - Taxation - Small Business

|

Start From Experience

ISBN: 9781997775522 / Angielski Termin realizacji zamówienia: ok. 5-8 dni roboczych. |

cena:

41,77 |

|

LLC Guide for Small Businesses: Master the Essentials from Legal Set Up, Launch to Creating a Scalable, Successful and Thriving Brand...it's Easy Once

ISBN: 9781917657006 / Angielski Termin realizacji zamówienia: ok. 5-8 dni roboczych. |

cena:

51,77 |

|

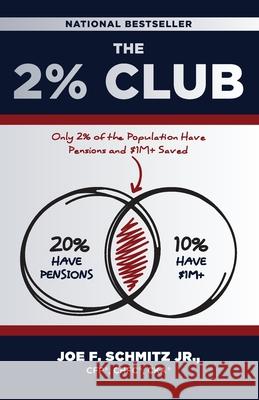

The 2% Club: Only 2% of the Population Have Pensions and $1M Saved

ISBN: 9781964046839 / Angielski Termin realizacji zamówienia: ok. 5-8 dni roboczych. |

cena:

71,80 |

|

Smart Business, Stupid Business: What School Never Taught You about Building a Successful Business

ISBN: 9781600377433 / Angielski / Miękka / 304 str. Termin realizacji zamówienia: ok. 5-8 dni roboczych. Smart Business, Stupid Business” provides a practical approach for the small business owner. This is a book written specifically for the small business owner with specific action steps. It's filled with meaningful information that cuts to the chase. It's the comprehensive content that turns any business owner into a Smarter Business Owner. Smart Business, Stupid Business” provides a practical approach for the small business owner. This is a book written specifically for the sma... |

cena:

75,83 |

|

Minding Your Business: A Guide to Money and Taxes for Creative Professionals

ISBN: 9781458437853 / Angielski / Miękka / 130 str. Termin realizacji zamówienia: ok. 5-8 dni roboczych. (Music Pro Guide Books & DVDs). Foreword by Ariel Hyatt. Martin Kamenski, a practicing CPA, unleashes years of tax experience on the creative community. He offers explanations in language that is easy for the most number-illiterate to understand. His Chicago-based practice serves clients nationwide and offers artists and creative professionals the explanations they need to make sense of the tangled web of the IRS. Kamenski provides guidance about when to treat yourself as a business. He will advise on the important considerations before incorporating. He will shatter some of the most...

(Music Pro Guide Books & DVDs). Foreword by Ariel Hyatt. Martin Kamenski, a practicing CPA, unleashes years of tax experience on the creative communit...

|

cena:

96,51 |

|

The Taxation of Small Businesses: (Sixth Edition)

ISBN: 9781907444739 / Angielski / Miękka / 502 str. Termin realizacji zamówienia: ok. 5-8 dni roboczych. This is a practical guide to all aspects of direct taxation of small businesses in the UK. Ideal for sole practitioners and small partnerships, the book will be a handy reference guide for all tax advisers. It provides a clear explanation of the relevant UK legislation and practical advice on ways of minimizing clients' tax liabilities and warning against common pitfalls. This sixth edition incorporates changes as a result of the UK's Finance Act 2013. The tax advantages of incorporating a small business need weighing up carefully, and business owners need to decide whether or not the...

This is a practical guide to all aspects of direct taxation of small businesses in the UK. Ideal for sole practitioners and small partnerships, the bo...

|

cena:

431,97 |

|

St. James's Place Tax Guide 2012-2013

ISBN: 9780230280021 / Angielski / Twarda / 450 str. Termin realizacji zamówienia: ok. 5-8 dni roboczych. The 41st annual edition of the leading guide to taxation in Britain. This practical and user-friendly guide is a bestseller with students, professionals, accountants and private individuals, explaining in simple terms how the UK tax system works and how best to minimise tax liabilities.

The 41st annual edition of the leading guide to taxation in Britain. This practical and user-friendly guide is a bestseller with students, professiona...

|

cena:

188,73 |

|

St. James's Place Tax Guide 2013-2014

ISBN: 9780230280038 / Angielski / Twarda / 460 str. Termin realizacji zamówienia: ok. 5-8 dni roboczych. The 42nd annual edition of the leading guide to taxation in Britain. This practical and user-friendly guide is a bestseller with students, professionals, accountants and private individuals, explaining in simple terms how the UK tax system works and how best to minimise tax liabilities.

The 42nd annual edition of the leading guide to taxation in Britain. This practical and user-friendly guide is a bestseller with students, professiona...

|

cena:

180,69 |

|

Starting Your Own Business: Do It Right from the Start, Lower Your Taxes, Protect Your Income, and Enjoy Your Life

ISBN: 9780996032902 / Angielski / Miękka / 282 str. Termin realizacji zamówienia: ok. 5-8 dni roboczych. Starting a business can be exciting and terrifying at the same time. If these thoughts have crossed your mind, then this is the right book for you. Written by Shauna Wekherlien, a CPA with her master's in taxation-and more commonly known as the Tax Goddess-this guide, the first in the series of Tax Goddess Guides, gives you real-life examples of the many opportunities and pitfalls of starting a new business. From what to research before you begin to legal and tax considerations, the experts you'll want on your team, strategies for marketing and sales, money management, and more, Wekherlien...

Starting a business can be exciting and terrifying at the same time. If these thoughts have crossed your mind, then this is the right book for you. Wr...

|

cena:

75,83 |

|

Taxation of Small Businesses: 2014-2015

ISBN: 9781907444838 / Angielski / Miękka / 496 str. Termin realizacji zamówienia: ok. 5-8 dni roboczych. Incorporating changes as a result of the UK's Finance Act, 2014, this seventh edition is a practical guide to all aspects of direct taxation of small businesses in the UK. The book will be an ideal handy reference guide for sole practitioners, small partnerships, and tax advisers, providing a clear explanation of relevant UK legislation and practical advice on ways of minimizing clients' tax liabilities and warning against common pitfalls. The tax advantages of incorporating a small business need weighing up carefully, and business owners need to decide whether or not the advantages outweigh...

Incorporating changes as a result of the UK's Finance Act, 2014, this seventh edition is a practical guide to all aspects of direct taxation of small ...

|

cena:

431,97 |

|

Taxation of Small Businesses 2015/16

ISBN: 9781910151075 / Angielski / Miękka / 497 str. Termin realizacji zamówienia: ok. 5-8 dni roboczych. This is a practical UK guide to all aspects of direct taxation of a small business. It is ideal for sole practitioners and small partnerships, but will be a handy reference guide for all UK tax advisers. The book gives a clear explanation of the relevant legislation and practical advice on ways of minimizing clients' tax liabilities and warning against common pitfalls. The tax advantages of incorporating a small business need weighing up carefully, and business owners need to decide whether or not the advantages outweigh the additional burden of compliance. This new edition has been updated...

This is a practical UK guide to all aspects of direct taxation of a small business. It is ideal for sole practitioners and small partnerships, but wil...

|

cena:

431,97 |

|

St. James's Place Tax Guide 2013-2014

ISBN: 9781349327256 / Angielski / Miękka / 460 str. Termin realizacji zamówienia: ok. 5-8 dni roboczych. The 42nd annual edition of the leading guide to taxation in Britain. This practical and user-friendly guide is a bestseller with students, professionals, accountants and private individuals, explaining in simple terms how the UK tax system works and how best to minimise tax liabilities.

The 42nd annual edition of the leading guide to taxation in Britain. This practical and user-friendly guide is a bestseller with students, professiona...

|

cena:

160,61 |

|

Taxation of Small Businesses 2016/17

ISBN: 9781910151174 / Angielski / Miękka / 480 str. Termin realizacji zamówienia: ok. 5-8 dni roboczych. This edition of The Taxation of Small Businesses is a practical guide to all aspects of direct taxation of small businesses in one volume. It is ideal for sole practitioners and small partnerships in the UK, but will be a handy reference guide for all tax advisers. The book aims to give a clear explanation of the relevant legislation and practical advice on ways of minimising clients' tax liabilities while warning against common pitfalls. The ninth edition has been updated to incorporate changes as a result of the Finance Bill 2016 as amended in Committee and Public Bill Committee, including...

This edition of The Taxation of Small Businesses is a practical guide to all aspects of direct taxation of small businesses in one volume. It is ideal...

|

cena:

457,13 |

|

Banish Your Bookkeeping Nightmares: The Go-To Guide for the Self-Employed to Save Money, Reduce Frustration, and Satisfy the IRS

ISBN: 9781945561078 / Angielski / Miękka / 126 str. Termin realizacji zamówienia: ok. 5-8 dni roboczych. Author of the top-selling The Accountant Beside You series, QuickBooks ProAdvisor, and CPA, Lisa London gives entrepreneurs step-by-step instruction in setting up their accounting systems, explains how to keep on top of the paperwork, how to file quarterly employment taxes, and details what is deductible and what isn't. London wants you to focus on growing your businesses, not on becoming accountants. Banish Your Bookkeeping Nightmares shows how to analyze what financial data is required, how to automate it where possible, how to keep it current without... Author of the top-selling The Accountant Beside You series, QuickBooks ProAdvisor, and CPA, Lisa London gives entrepreneurs step-b... |

cena:

56,83 |

|

Taxation of Small Businesses: 2017-2018

ISBN: 9781910151600 / Angielski / Miękka / 480 str. Termin realizacji zamówienia: ok. 5-8 dni roboczych. The Taxation of Small Businesses 2017-18 is a practical guide to all aspects of direct taxation of small businesses in one volume. It is ideal for sole practitioners and small partnerships, but will be a handy reference guide for all tax advisers. The book aims to give a clear explanation of the relevant legislation and practical advice on ways of minimising clients' tax liabilities and warning against common pitfalls. The tenth edition has been updated to incorporate changes as a result of the Finance Act 2017. Includes recent case law developments on "gig economy" employment. The tax...

The Taxation of Small Businesses 2017-18 is a practical guide to all aspects of direct taxation of small businesses in one volume. It is ideal for sol...

|

cena:

457,13 |

|

The Small-Business Guide to Government Contracts: How to Comply with the Key Rules and Regulations . . . and Avoid Terminated Agreements, Fines, or Wo

ISBN: 9780814439722 / Angielski / Miękka / 352 str. Termin realizacji zamówienia: ok. 5-8 dni roboczych. |

cena:

106,39 |

|

Cryptocurrency: The 10 Biggest Trading Mistakes Newbies Make - And How To Avoid Them

ISBN: 9781981765249 / Angielski / Miękka / 102 str. Termin realizacji zamówienia: ok. 5-8 dni roboczych. |

cena:

31,89 |

|

Cryptocurrency: 13 More Coins to Watch with 10X Growth Potential in 2018

ISBN: 9781983775512 / Angielski / Miękka / 108 str. Termin realizacji zamówienia: ok. 5-8 dni roboczych. |

cena:

31,89 |

|

Cryptocurrency: Mining for Beginners - How You Can Make Up To $18,500 a Year Mining Coins From Home

ISBN: 9781985683570 / Angielski / Miękka / 102 str. Termin realizacji zamówienia: ok. 5-8 dni roboczych. |

cena:

47,85 |

|

Cryptocurrency: What You Need to Know About Your Taxes to Save Money and Avoid a Nasty Surprise from the IRS

ISBN: 9781985837997 / Angielski / Miękka / 90 str. Termin realizacji zamówienia: ok. 5-8 dni roboczych. |

cena:

43,86 |