» książki » Business & Economics - Taxation - Corporate

|

Der Einspruch Im Steuerrecht: Grundlagen Und Praxis

ISBN: 9783658270216 / Niemiecki / Miękka / 162 str. Termin realizacji zamówienia: ok. 5-8 dni roboczych. |

cena:

142,92 |

|

Governing Corporate Tax Management: The Role of State Ownership, Institutions and Markets in China

ISBN: 9789811398285 / Angielski / Twarda / 186 str. Termin realizacji zamówienia: ok. 5-8 dni roboczych. |

cena:

442,79 |

|

Das Liechtensteinische Steuerrecht: Grundlagen Und Regelungen Inklusive Besteuerung Von Blockchain- Und Fintech-Unternehmen

ISBN: 9783658270902 / Niemiecki / Miękka / 266 str. Termin realizacji zamówienia: ok. 5-8 dni roboczych. |

cena:

206,88 |

|

Körperschaftsteuer in Der Unternehmenspraxis: Steuerliche Optimierung Für Unternehmer Und Unternehmen

ISBN: 9783658199609 / Niemiecki / Miękka / 440 str. Termin realizacji zamówienia: ok. 5-8 dni roboczych. schneller. gut. beraten.

schneller. gut. beraten.

|

cena:

244,52 |

|

Quality of Internal Auditing in the Public Sector: Perspectives from the Bulgarian and International Context

ISBN: 9783030293284 / Angielski / Twarda / 266 str. Termin realizacji zamówienia: ok. 5-8 dni roboczych. |

cena:

402,53 |

|

Educational Transformation

ISBN: 9781796048957 / Angielski / Miękka / 320 str. Termin realizacji zamówienia: ok. 5-8 dni roboczych. |

cena:

75,98 |

|

Ultimate Guide: Take Your Accounting Practice To The Next Level With Internet Marketing: For Ambitious Accounting Professionals That W

ISBN: 9781976237201 / Angielski / Miękka / 112 str. Termin realizacji zamówienia: ok. 5-8 dni roboczych. |

cena:

387,14 |

|

Finanzethik Und Steuergerechtigkeit

ISBN: 9783658277826 / Niemiecki / Miękka / 135 str. Termin realizacji zamówienia: ok. 5-8 dni roboczych. |

cena:

142,92 |

|

Die Investmentsteuerreform 2018: Steuerliche Wirkungsanalyse Und Möglichkeit Zur Optimierung Der Portfoliostruktur

ISBN: 9783658277499 / Niemiecki / Miękka / 227 str. Termin realizacji zamówienia: ok. 5-8 dni roboczych. |

cena:

263,32 |

|

Topmanager Sind Einsame Spitze: Höhenflüge in Dünner Luft

ISBN: 9783658263454 / Niemiecki / Mixed Media Product / 255 str. Termin realizacji zamówienia: ok. 5-8 dni roboczych. |

cena:

89,42 |

|

Umwandlungssteuerrecht: Grundlagen Für Studium Und Steuerberaterprüfung

ISBN: 9783658279790 / Niemiecki / Miękka / 588 str. Termin realizacji zamówienia: ok. 5-8 dni roboczych. |

cena:

131,64 |

|

Kapitaleinkünfte Und Spekulationsgeschäfte: Rechtsgrundlagen Und Besteuerung

ISBN: 9783658230173 / Niemiecki / Miękka / 353 str. Termin realizacji zamówienia: ok. 5-8 dni roboczych. |

cena:

206,88 |

|

Principios de contabilidad: La guía definitiva para principiantes sobre contabilidad

ISBN: 9781689162395 / Hiszpański / Miękka / 180 str. Termin realizacji zamówienia: ok. 5-8 dni roboczych. |

cena:

81,38 |

|

Taxes in America: What Everyone Needs to Know(r)

ISBN: 9780190920869 / Angielski / Twarda / 362 str. Termin realizacji zamówienia: ok. 5-8 dni roboczych. |

cena:

227,16 |

|

Investment in Thailand: Das Rechts- Und Steuerhandbuch Für Den Praktiker

ISBN: 9783658253851 / Niemiecki / Miękka / 388 str. Termin realizacji zamówienia: ok. 5-8 dni roboczych. |

cena:

188,08 |

|

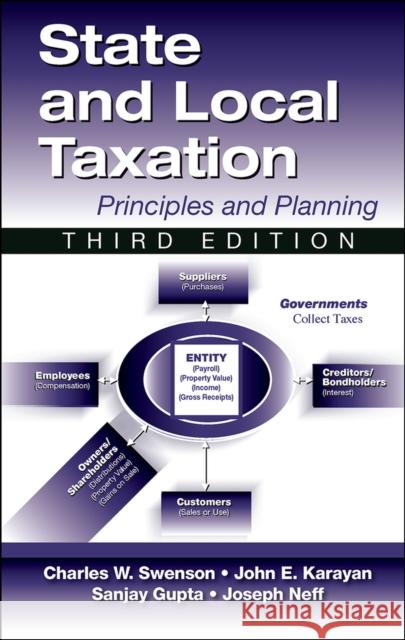

State and Local Taxation: Principles and Practices, 3rd Edition

ISBN: 9781604270952 / Angielski / Twarda / 328 str. Termin realizacji zamówienia: ok. 5-8 dni roboczych. |

cena:

301,18 |

|

Ertragsteuern: Einkommensteuer, Körperschaftsteuer, Gewerbesteuer

ISBN: 9783658260040 / Niemiecki / Miękka / 577 str. Termin realizacji zamówienia: ok. 5-8 dni roboczych. |

cena:

150,44 |

|

Auswirkungen Einer Vermögensteuer Auf Familienunternehmen: Eine Ökonomische Analyse

ISBN: 9783658292645 / Niemiecki / Miękka / 288 str. Termin realizacji zamówienia: ok. 5-8 dni roboczych. |

cena:

263,32 |

|

Zum Einfluss Des Besteuerungszeitpunktes Auf Das Ausübungsverhalten Vergütungshalber Gewährter Optionen

ISBN: 9783658293147 / Niemiecki / Miękka / 177 str. Termin realizacji zamówienia: ok. 5-8 dni roboczych. |

cena:

244,52 |

|

Immobilien Und Steuern: Kompakte Darstellung Für Die Praxis

ISBN: 9783658293321 / Niemiecki / Twarda / 301 str. Termin realizacji zamówienia: ok. 5-8 dni roboczych. |

cena:

263,32 |