» książki » Business & Economics - Taxation - General

|

Read My Lips: Why Americans Are Proud to Pay Taxes

ISBN: 9780691191607 / Angielski / Miękka / 304 str. Termin realizacji zamówienia: ok. 5-8 dni roboczych. |

cena:

110,46 zł |

|

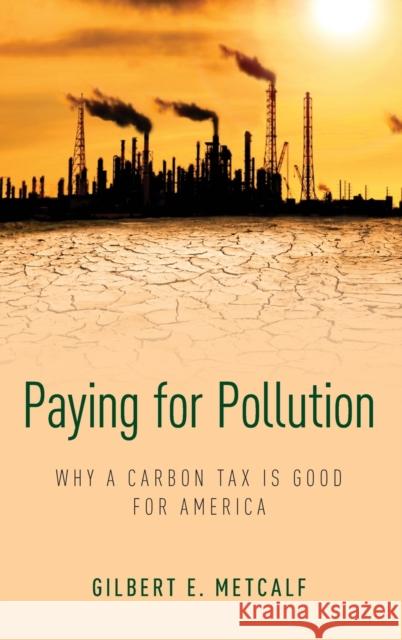

Paying for Pollution: Why a Carbon Tax Is Good for America

ISBN: 9780190694197 / Angielski / Twarda / 200 str. Termin realizacji zamówienia: ok. 5-8 dni roboczych. |

cena:

200,11 zł |

|

China Accounting Standards: Introduction and Effects of New Chinese Accounting Standards for Business Enterprises

ISBN: 9789811012853 / Angielski / Miękka / 337 str. Termin realizacji zamówienia: ok. 5-8 dni roboczych. |

cena:

547,24 zł |

|

How to Legally Reduce Your Tax: Without Losing Any Money!

ISBN: 9780648258308 / Angielski / Miękka / 188 str. Termin realizacji zamówienia: ok. 5-8 dni roboczych. |

cena:

97,80 zł |

|

Tax Rates and Tables 2019/20: Budget Edition

ISBN: 9781526509383 / Angielski / Miękka / 280 str. Termin realizacji zamówienia: ok. 5-8 dni roboczych. Bloomsbury's Tax Rates and Tables 2019/20: Budget Edition provide comprehensive, post-Budget coverage of the new revised tax rates, allowances and reliefs, following the October 2018 Budget. Also contains commentary throughout to help with understanding Includes devolved Scottish and Welsh Taxes

Bloomsbury's Tax Rates and Tables 2019/20: Budget Edition provide comprehensive, post-Budget coverage of the new revised tax rates, allowances and rel...

|

cena:

131,18 zł |

|

Introduction to Chinese Fiscal System

ISBN: 9789811341854 / Angielski / Miękka / 300 str. Termin realizacji zamówienia: ok. 5-8 dni roboczych. |

cena:

195,42 zł |

|

Principles of International Taxation

ISBN: 9781526510396 / Angielski / Miękka / 696 str. Termin realizacji zamówienia: ok. 5-8 dni roboczych. Provides a clear introduction to international taxation and offers more in-depth material on many important areas of the subject. The book presents its material in a global context, explaining the variety of approaches used around the world to deal with the central issues that arise in international tax. Fully updated to cover all new tax legislation and developments in light of the OECD BEPS project implementation, key areas included in this seventh edition are: US tax reform package: Tax cuts and Jobs Act which came into effect on 1 January 2018. This reform is a sweeping overhaul that...

Provides a clear introduction to international taxation and offers more in-depth material on many important areas of the subject. The book presents it...

|

cena:

629,62 zł |

|

Tax Increment Financing and Economic Development, Second Edition

ISBN: 9781438474984 / Angielski / Miękka / 366 str. Termin realizacji zamówienia: ok. 5-8 dni roboczych. |

cena:

148,95 zł |

|

Taxes, Tariffs, & Subsidies: A history of Canadian fiscal development (Vol. 2)

ISBN: 9781487581893 / Angielski / Miękka / 452 str. Termin realizacji zamówienia: ok. 5-8 dni roboczych. |

cena:

284,37 zł |

|

Give and Take: The Citizen-Taxpayer and the Rise of Canadian Democracy

ISBN: 9780774836739 / Angielski / Miękka / 448 str. Termin realizacji zamówienia: ok. 5-8 dni roboczych. |

cena:

157,35 zł |

|

The Interregional Effects of Canadian Tariffs and Transportation Policy

ISBN: 9781487587291 / Angielski / Miękka / 162 str. Termin realizacji zamówienia: ok. 5-8 dni roboczych. |

cena:

104,88 zł |

|

Fiscal Decentralization Reform in Cambodia: Progress over the Past Decade and Opportunities

ISBN: 9789292614867 / Angielski / Miękka / 72 str. Termin realizacji zamówienia: ok. 5-8 dni roboczych. |

cena:

102,73 zł |

|

Modernizing Vats in Africa

ISBN: 9780198844075 / Angielski / Twarda / 368 str. Termin realizacji zamówienia: ok. 5-8 dni roboczych. |

cena:

528,22 zł |

|

National Insurance Contributions 2019/20

ISBN: 9781526510259 / Angielski / Miękka / 432 str. Termin realizacji zamówienia: ok. 5-8 dni roboczych. National Insurance Contributions 2019/20 covers all classes of UK National Insurance contributions. It explains where a liability arises under each class and how to calculate that liability, as well as describing the associated administrative requirements. It also considers international issues for British citizens working abroad and foreign nationals working in the UK. This title contains the key information practitioners need to know about this specialist area including: Coverage of all classes of NICs and international issues Appendices showing rates of each class of NIC for the last 6...

National Insurance Contributions 2019/20 covers all classes of UK National Insurance contributions. It explains where a liability arises under each cl...

|

cena:

629,62 zł |

|

Formalisation Through Taxation: Paraguay's Approach and Its Implications

ISBN: 9783030292812 / Angielski / Twarda / 117 str. Termin realizacji zamówienia: ok. 5-8 dni roboczych. |

cena:

195,42 zł |

|

Tax Policy and the Economy, Volume 34, 34

ISBN: 9780226708119 / Angielski / Miękka / 256 str. Termin realizacji zamówienia: ok. 5-8 dni roboczych. |

cena:

265,10 zł |

|

An Economic Analysis of Income Tax Reforms

ISBN: 9781138608696 / Angielski / Miękka / 20 str. Termin realizacji zamówienia: ok. 5-8 dni roboczych. |

cena:

41,93 zł |

|

Central Banking Before 1800: A Rehabilitation

ISBN: 9780198849995 / Angielski / Twarda / 336 str. Termin realizacji zamówienia: ok. 5-8 dni roboczych. |

cena:

493,43 zł |

|

Who Pays for Canada?: Taxes and Fairness

ISBN: 9780228001249 / Angielski / Miękka / 424 str. Termin realizacji zamówienia: ok. 5-8 dni roboczych. |

cena:

188,88 zł |

|

Land Value Taxation in Britain: Experience and Opportunities

ISBN: 9781558441576 / Angielski / Miękka / 216 str. Termin realizacji zamówienia: ok. 5-8 dni roboczych. |

cena:

138,08 zł |