Ideas for Saving America: start in 2012 » książka

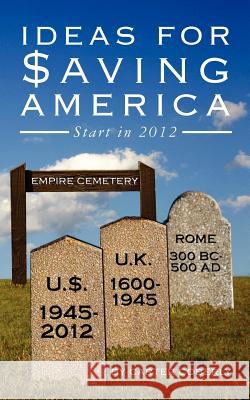

Ideas for Saving America: start in 2012

ISBN-13: 9781466463370 / Angielski / Miękka / 2011 / 98 str.

Overburdened taxpayer, Would you like to pay much less in taxes, never have to fill-out a federal or state income tax form again, and yet have the U.S. federal, state, and local governments adequately funded? Would you like to eliminate U.S. deficits forever, pay only your fair share of taxes, and create an environment where job creation explodes? Would you like to guarantee that Social Security will thrive rather than implode? If you answered yes to these questions, then it's time for changes to be made in America's tax laws. The U.S. federal, state, and local governments have many ways that they collect taxes from you. They include income tax, sales tax, property tax, fuel tax, sin tax, excise tax, Social Security tax, Medicare tax, and many more. Of these taxes, the most expensive tax to collect and the most open to fraud is income tax. For you to determine your income tax liability, the government requires that you keep detailed records of all your income and expenses. You are then required to understand the thousands of pages of income tax law to determine what income is to be taxed and what expenses may be deducted. Some expenses are handled as deductions, while others as credits. Special tax exemptions are included in the laws to minimize taxes for the benefit of some people with access and influence within the government. If you run your own business, the deductions allowed are different than if you are an employee. The time required for you to track all your information, understand the tax laws that apply to you, and then determine your tax liability is significant. Many small businesses have failed, not because they didn't provide a needed product or service, but simply because they couldn't afford the bookkeeping expenses required to track and determine their income tax liability. Federal income taxes were first charged in 1913 because of the 16th Amendment to the U.S. Constitution. The amendment was sold to the American people and state legislatures as a tax on the super-rich only, never to touch the middle and lower classes. The original tax rates ranged from 1% to 7% of net income. After 100 years of the income tax experiment, it is time to replace the 16th Amendment with a simpler and fairer tax. The median American family earns about $50,000 per year. The total taxes collected from the average family is approximately 30% or $15,000 per year, leaving the average family with about $35,000 per year to pay for all other expenses. Federal and state income taxes account for about 1/3 of the total taxes paid, or $5,000 per year. There are simpler and fairer ways for the government to collect the tax revenues they need and eliminate the complexity associated with income tax laws, reduce the time taxpayers spend tracking income and expenses, and make the tax code fairer for all of its citizens. Businesses will be able to focus on expanding their products or services rather tracking their income and expenses in order to minimize income taxes. Would you like to know how this is possible? Answers are provided in this book. Ideas for fundamental changes are presented. The author describes how income taxes should be repealed and replaced. Significant benefits will be gained from these changes. If you are like most people, worried about the future of America, then it's time to look at new ways to solve today's problems and return America back on the road to greatness. Now is the time to take action, before the financial problems become too great. This book will help you understand how making tax law changes will solve America's financial and employment problems. The future will be based on what we citizens do today in taking back control of our country and how we are taxed. It is urgent that you read this book now and get behind a movement to change America. Join other Americans in a movement to save our way of life for our children and grandchildren.

Zawartość książki może nie spełniać oczekiwań – reklamacje nie obejmują treści, która mogła nie być redakcyjnie ani merytorycznie opracowana.