Game Over: The Inside Story of the Greek Crisis » książka

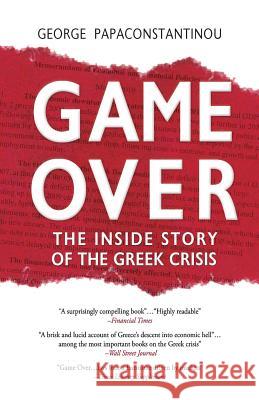

Game Over: The Inside Story of the Greek Crisis

ISBN-13: 9781530703265 / Angielski / Miękka / 2016 / 336 str.

Praise for Game Over: "A surprisingly compelling book.."."Highly readable" - Peter Spiegel in the Financial Times "A brisk and lucid account of Greece's descent into economic hell.."."among the most important books on the Greek crisis" - Marcus Walker in the Wall Street Journal "Game Over....lays bare a Eurozone driven by markets" - Times Literary Supplement "The most important book to date on the 6-year crisis" - Kathimerini "The pages where the political account turns into a legal and existential thriller are some of the most electrifying" - Ta Nea "A Greek patriot's important, readable chronicle" Fmr. EU Commissioner Olli Rehn "More suspense than in Stieg Larsson's trilogy. Excellent, scary and well written. Highly recommended " Jens Henriksson "You don't get closer to the Greek tragedy than this.... A must-read, for insiders and outsiders" - @w_lelieveld "The best book about the Greek crisis comes from an insider: 'Game Over' is a must read " - @jens_bastian In this real-life political thriller, former Finance Minister George Papaconstantinou tells the inside story of the six years during which the Greek drama changed Europe and riveted the world. It is the story of a country forced by past mistakes into unprecedented actions with enormously painful consequences. A story about the people who shaped events by trying to respond to rapidly evolving circumstances often beyond their control. About decisions - good and bad, right and wrong - taken in official and behind-the-scenes gatherings in Brussels, Berlin, Frankfurt, Paris, London, New York, Washington and Athens; in Luxembourg chateaux courtyards, Davos kitchens and Bilderberg gatherings; in elegant offices and dreary basement meetings rooms. The story begins in October 2009 in Athens, when after a landslide victory, the new government shocks the world by announcing a fiscal deficit of an alarming size, until then kept secret. The "accident waiting to happen" since the launch of the Euro is finally here - but there are no contingency plans to deal with it, and the systemic nature of the crisis is initially not fully appreciated. When a bailout mechanism is finally put together, it fails to convince markets that the Eurozone will do whatever it takes to prevent the bankruptcy of one of its members. The bluff is called, and Greece is forced to apply in May 2010 for a massive loan from the Eurozone and the IMF, and accept a harsh austerity program. As the first loan installment arrives one day before the country declares default, the first wage and pension cuts produce riots and social unrest which leave three people dead. But the crisis is not over - it mutates. Delays in recognizing the problem and mistakes in the way it is dealt with end up opening the gates of hell for the entire Eurozone. Ireland is forced into a bailout - Portugal follows. And in Greece, the initial good program results are soon swept away by the concern in international markets that Greece might exit the Eurozone. Meanwhile the continuing austerity leads to an ever-deeper recession, rapidly rising unemployment, increasing social tensions, and real suffering. Six years down the road since the crisis erupted, Greece is in its third bailout, still in a severe social and economic crisis, and there are so many questions. Were other solutions available? Should Greece have threatened to default in order to get a better deal? Should there have been debt relief from the beginning? Would Greece have been better off if it had left the Euro? Has Greece saved the Euro but not itself? The book addresses these questions with the eye of someone at the heart of decision-making during the crisis. This is the breath-taking story of an incredible period, told for the first time not by an outside observer, but by one of its protagonists.

Zawartość książki może nie spełniać oczekiwań – reklamacje nie obejmują treści, która mogła nie być redakcyjnie ani merytorycznie opracowana.