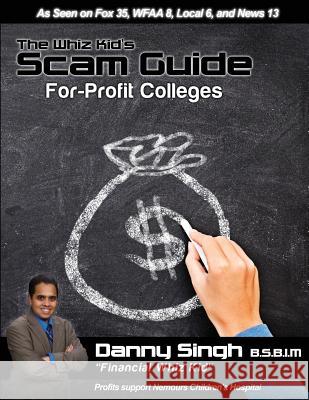

The Whiz Kid's Scam Guide: For-Profit Colleges (Everest, ITT Tech, Ashworth): Meet the Traditional, Non-Traditional, and Community College Studen » książka

The Whiz Kid's Scam Guide: For-Profit Colleges (Everest, ITT Tech, Ashworth): Meet the Traditional, Non-Traditional, and Community College Studen

ISBN-13: 9781495319679 / Angielski / Miękka / 2014 / 144 str.

The Whiz Kid's Scam Guide: For-Profit Colleges (Everest, ITT Tech, Ashworth): Meet the Traditional, Non-Traditional, and Community College Studen

ISBN-13: 9781495319679 / Angielski / Miękka / 2014 / 144 str.

(netto: 26,87 VAT: 5%)

Najniższa cena z 30 dni: 27,08

ok. 16-18 dni roboczych.

Darmowa dostawa od 40 zł!

Profits Support the Nemours Children's Hospital in Orlando, Florida The student loan debt is over 1 trillion dollars because an increasing number of students are going to college in the hopes of later finding a good paying job. For this reason, students feel comfortable accepting loans thinking the return they will receive through employment will offset the debts. The rough economic conditions are proving otherwise because the number of students paying late on their loans is exceeding the number of students graduating from college. As evidence, the student loan default rates have doubled and there are not enough jobs for everyone. The price of tuition is increasing as the overall amount of financial aid is decreasing and student loans still cannot be eliminated with bankruptcy. A large majority of students going back to school are non-traditional meaning they are single parents, working adults, veterans, ex-convicts, students with disabilities, or students who did not start college after high school. The growth of the non-traditional students is causing the growth of the for-profit colleges such as the Westwood College, ITT Tech, Everest University, and other schools similar to them. These schools are different from the non-profit schools such as the University of Central Florida, Seminole State College, Stetson University, and Florida State University because they are operated by a company who funds them and gets returns through the tuition paid by students. The for-profit colleges have very expensive tuition compared to the non-profit colleges. They claim they can provide a high quality education to the non-traditional students who may struggle to academically succeed in a traditional college setting- But are for-profit colleges everything they make themselves out to be? Research shows 90% of the money made by for-profit colleges come from the financial aid granted to students by the government. The majority of students paying late on their loans are for-profit college students. Coincidentally, the majority of for-profit colleges have extremely low graduation rates. Half of the students who attend a for-profit college do not graduate with a degree or diploma but only with debt. A growing number of peculiar cases are developing with the for-profit college industry involving aggressive recruitment tactics, the creation of fake transcripts, creation of fake visas for students, instructors not having advanced degrees, fake accreditation, and how a dog was able to earn the MBA. Let the 20-year-old traditional, non-traditional, and community college "financial whiz kid" student, Danny Singh, share with you the business secrets behind the for-profit colleges, how students can protect themselves from being scammed, and better alternatives to for-profit colleges. Singh is the teenager who took over his mother's finances at age 11 and refinanced her house and car at age 14. Singh has been training students to repay their loans in an effective manner and felt the need to publish this book because for-profit colleges deceived many of his clients. Please share the information within this book.

Zawartość książki może nie spełniać oczekiwań – reklamacje nie obejmują treści, która mogła nie być redakcyjnie ani merytorycznie opracowana.